Business, 27.11.2019 04:31 christianconklin22

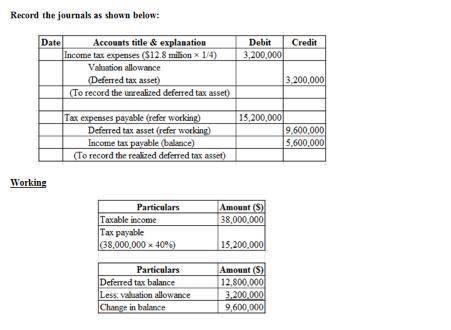

At the end of the year, the deferred tax asset account had a balance of $12.8 million attributable to a cumulative temporary difference of $32 million in a liability for estimated expenses. taxable income is $38.0 million. no temporary differences existed at the beginning of the year, and the tax rate is 40%.prepare the journal entry(s) to record income taxes assuming it is more likely than not that one-fourth of the deferred tax asset will not ultimately be realized. note: these are the correct entries, i am just missing the values (dta is not zero): debit: income tax expense deferred tax asset : income tax payable 15.2debit: income tax expense : valuation allowance - deferred tax asset

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

The federal act which provided over $7 billion to the epa to protect and promote "green" jobs and a healthier environment is the - national environmental policy act. - resource recovery act.- resource conservation and recovery act.- american recovery and reinvestment act. - clean air act.

Answers: 1

Business, 22.06.2019 17:00

Oliver is the vice president of production at his company and has been managing the launch of new software systems. he worked with a team of individuals who were tasked to create awareness about a specific product and also to approach potential purchasers of the product. which department managers were part of oliver’s team?

Answers: 3

Business, 22.06.2019 18:20

Now ray has had the tires for two months and he notices that the tread has started to pull away from the tire. he has already contacted the place who sold the tires and calmly and accurately explained the problem. they didn’t him because they no longer carry that tire. so he talked with the manager and he still did not get the tire replaced. his consumer rights are being violated. pretend you are ray and write a letter to the company’s headquarters. here are some points to keep in mind when writing the letter: include your name, address, and account number, if appropriate. describe your purchase (name of product, serial numbers, date and location of purchase). state the problem and give the history of how you tried to resolve the problem. ask for a specific action. include how you can be reached.

Answers: 3

Business, 22.06.2019 20:00

What is the difference between total utility and marginal utility? a. marginal utility is subject to the law of diminishing marginal utility while total utility is not. b. total utility represents the consumer optimum while marginal utility gives the total utility per dollar spent on the last unit. c. total utility is the total amount of satisfaction derived from consuming a certain amount of a good while marginal utility is the additional satisfaction gained from consuming an additional unit of the good. d. marginal utility represents the consumer optimum while total utility gives the total utility per dollar spent on the last unit.

Answers: 3

You know the right answer?

At the end of the year, the deferred tax asset account had a balance of $12.8 million attributable t...

Questions

Mathematics, 18.03.2021 01:10

English, 18.03.2021 01:10

French, 18.03.2021 01:10

Mathematics, 18.03.2021 01:10

Mathematics, 18.03.2021 01:10

Computers and Technology, 18.03.2021 01:10

Mathematics, 18.03.2021 01:10

English, 18.03.2021 01:10

English, 18.03.2021 01:10

Biology, 18.03.2021 01:10

Mathematics, 18.03.2021 01:10