Business, 27.11.2019 02:31 jhanellemo0112

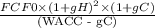

Gonzales corporation generated free cash flow of $88 million this year. for the next two years, the companyʹs free cash flow is expected to grow at a rate of 10%. after that time, the companyʹsfree cash flow is expected to level off to the industry long-term growth rate of 4% per year. ifthe weighted average cost of capital is 12% and gonzales corporation has cash of $100 million, debt of $300 million, and 100 million shares outstanding, what is gonzales corporationʹsexpected terminal enterprise value in year 2? a) $1384.24b) $1245.82c) $1107.39d) $968.97

Answers: 2

Another question on Business

Business, 22.06.2019 01:00

How does the economy of cuba differ from the economy of north korea? in north korea, the government’s control of the economy has begun to loosen. in cuba, the government maintains a tight hold over the economy. in cuba, the government’s control of the economy has begun to loosen. in north korea, the government maintains a tight hold over the economy. in north korea, there is economic uncertainty in exchange for individual choice. in cuba, there is economic security in exchange for government control. in cuba, there is economic uncertainty in exchange for individual choice. in north korea, there is economic security in exchange for government control.\

Answers: 2

Business, 22.06.2019 06:10

Investment x offers to pay you $5,700 per year for 9 years, whereas investment y offers to pay you $8,300 per year for 5 years. if the discount rate is 6 percent, what is the present value of these cash flows? (do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) present value investment x $ investment y $ if the discount rate is 16 percent, what is the present value of these cash flows? (do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) present value investment x $ investment y

Answers: 1

Business, 22.06.2019 18:00

When peter metcalf describes black diamond’s manufacturing facility in china as a “greenfield project,” he means that partnered with a chinese company to buy the plant . of all market entry strategies, this one carries the lowest risk. because black diamond manufactures its outdoor sports products outside the united states, what risks must its managers be aware of?

Answers: 1

Business, 22.06.2019 18:10

Ashop owner uses a reorder point approach to restocking a certain raw material. lead time is six days. usage of the material during lead time is normally distributed with a mean of 42 pounds and a standard deviation of four pounds. when should the raw material be reordered if the acceptable risk of a stockout is 3 percent?

Answers: 1

You know the right answer?

Gonzales corporation generated free cash flow of $88 million this year. for the next two years, the...

Questions

Social Studies, 11.06.2021 01:00

Social Studies, 11.06.2021 01:00

Arts, 11.06.2021 01:00

Mathematics, 11.06.2021 01:00

English, 11.06.2021 01:00

Advanced Placement (AP), 11.06.2021 01:00

Chemistry, 11.06.2021 01:00