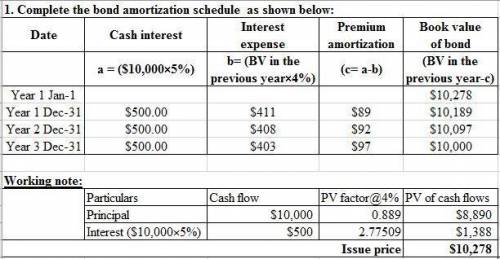

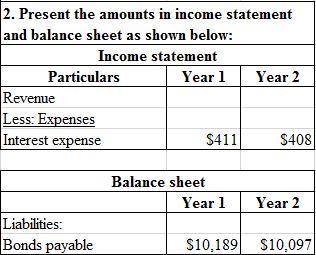

On january 1 of this year, houston company issued a bond with a face value of $10,000 and a coupon rate of 5 percent. the bond matures in three years and pays interest every december 31. when the bond was issued, the annual market rate of interest was 4 percent. houston uses the effective-interest amortization method.

required:

1. complete a bond amortization schedule for all three years of the bond’s life.

2. what amounts will be reported on the income statement and balance sheet at the end of year 1 and year 2?

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

In addition to having a bachelor's degree in accounting, a certification will increase a tax accountant's job opportunities and allow them to file reports with the

Answers: 1

Business, 22.06.2019 11:00

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Business, 22.06.2019 12:30

Amap from a trade development commission or chamber of commerce can be more useful than google maps for identifying

Answers: 1

Business, 22.06.2019 19:00

What is an equation of the line in slope intercept formm = 4 and the y-intercept is (0,5)y = 4x-5y = -5x +4y = 4x + 5y = 5x +4

Answers: 1

You know the right answer?

On january 1 of this year, houston company issued a bond with a face value of $10,000 and a coupon r...

Questions

English, 08.08.2019 22:10

Physics, 08.08.2019 22:10