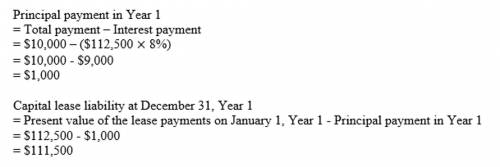

On january 1, 20x5, blaugh co. signed a long-term lease for an office building. the terms of the lease required blaugh to pay $10,000 annually, beginning december 30, 20x5 and continuing each year for 30 years. the lease qualifies as a finance lease. on january 1, 20x5, the present value of the lease payments is $112,500 at the 8% interest rate implicit in the lease. in blaugh's december 31, 20x5 balance sheet, the finance lease liability should be

Answers: 3

Another question on Business

Business, 22.06.2019 12:10

In year 1, the bennetts' 25-year-old daughter, jane, is a full-time student at an out-of-state university but she plans to return home after the school year ends. in previous years, jane has never worked and her parents have always been able to claim her as a dependent. in year 1, a kind neighbor offers to pay for all of jane's educational and living expenses. which of the following statements is most accurate regarding whether jane's parents would be allowed to claim an exemption for jane in year 1 assuming the neighbor pays for all of jane's support? a.no, jane must include her neighbor's gift as income and thus fails the gross income test for a qualifying relative.b.yes, because she is a full-time student and does not provide more than half of her own support, jane is considered her parent's qualifying child.c.no, jane is too old to be considered a qualifying child and fails the support test of a qualifying relative.d.yes, because she is a student, her absence is considered as "temporary." consequently she meets the residence test and is a considered a qualifying child of the bennetts.

Answers: 2

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 3

Business, 23.06.2019 00:10

Warren company plans to depreciate a new building using the double declining-balance depreciation method. the building cost $870,000. the estimated residual value of the building is $57,000 and it has an expected useful life of 20 years. assuming the first year's depreciation expense was recorded properly, what would be the amount of depreciation expense for the second year?

Answers: 2

Business, 23.06.2019 01:00

"consists of larger societal forces that affect how a company engages and serves its customers."

Answers: 1

You know the right answer?

On january 1, 20x5, blaugh co. signed a long-term lease for an office building. the terms of the lea...

Questions

Mathematics, 09.01.2020 04:31

Social Studies, 09.01.2020 04:31

Advanced Placement (AP), 09.01.2020 04:31

World Languages, 09.01.2020 04:31

Mathematics, 09.01.2020 04:31

English, 09.01.2020 04:31

Mathematics, 09.01.2020 04:31

Biology, 09.01.2020 04:31

Mathematics, 09.01.2020 05:31

Chemistry, 09.01.2020 05:31

Mathematics, 09.01.2020 05:31

English, 09.01.2020 05:31