Business, 26.11.2019 05:31 maddyclark19

On january 1, 2018, the general ledger of grand finale fireworks includes the following account balances:

accounts debit credit

cash $ 43,200

accounts receivable 45,500

supplies 8,000

equipment 69,000

accumulated depreciation $ 9,500

accounts payable 15,100

common stock, $1 par value 15,000

additional paid-in capital 85,000

retained earnings 41,100

totals $ 165,700 $ 165,700

during january 2018, the following transactions occur:

january 2 issue an additional 2,000 shares of $1 par value common stock for $40,000.

january 9 provide services to customers on account, $15,600.

january 10 purchase additional supplies on account, $5,400.

january 12 repurchase 1,200 shares of treasury stock for $17 per share.

january 15 pay cash on accounts payable, $17,000.

january 21 provide services to customers for cash, $49,600.

january 22 receive cash on accounts receivable, $17,100.

january 29 declare a cash dividend of $0.30 per share to all shares outstanding on january 29. the dividend is payable on february 15. (hint: grand finale fireworks had 15,000 shares outstanding on january 1, 2018 and dividends are not paid on treasury stock.)

january 30 reissue 800 shares of treasury stock for $19 per share.

january 31 pay cash for salaries during january, $42,500.

1. record each of the transactions listed above.

a. unpaid utilities for the month of january are $6,700.

b. supplies at the end of january total $5,600.

c. depreciation on the equipment for the month of january is calculated using the straight-line method. at the time the equipment was purchased, the company estimated a service life of three years and a residual value of $10,500.

d. accrued income taxes at the end of january are $2,500.

2. record the adjusting entries on january 31, 2018 for the above transactions.

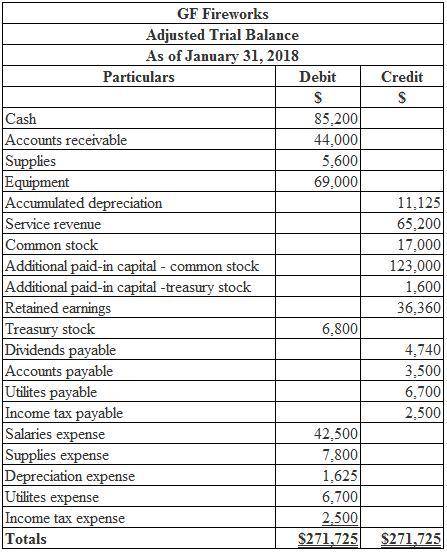

3. prepare an adjusted trial balance as of january 31, 2018.

4. prepare a multiple-step income statement for the period ended january 31, 2018.

5. prepare a classified balance sheet as of january 31, 2018.

on january 1, 2018, the general ledger of grand finale fireworks includes the following account balances: accounts debit credit cash $ 43,200 accounts receivable 45,500 supplies 8,000 equipment 69,000 accumulated depreciation $ 9,500 accounts payable 15,100 common stock, $1 par value 15,000 additional paid-in capital 85,000 retained earnings 41,100 totals $ 165,700 $ 165,700

Answers: 1

Another question on Business

Business, 21.06.2019 18:30

What is the communication process? why isnt it possible to communicate without using all the elements in the communication process?

Answers: 3

Business, 22.06.2019 10:30

Factors like the unemployment rate, the stock market, global trade, economic policy, and the economic situation of other countries have no influence on the financial status of individuals. ( t or f)

Answers: 1

Business, 22.06.2019 19:40

When a company produces and sells x thousand units per week, its total weekly profit is p thousand dollars, where upper p equals startfraction 800 x over 100 plus x squared endfraction . the production level at t weeks from the present is x equals 4 plus 2 t. find the marginal profit, startfraction dp over dx endfraction and the time rate of change of profit, startfraction dp over dt endfraction . how fast (with respect of time) are profits changing when tequals8?

Answers: 1

Business, 22.06.2019 23:00

Which completes the equation? o + a + consideration (+ = k legal capacity legal capability legal injunction legal corporation

Answers: 1

You know the right answer?

On january 1, 2018, the general ledger of grand finale fireworks includes the following account bala...

Questions

Physics, 13.10.2019 12:20

Social Studies, 13.10.2019 12:20

History, 13.10.2019 12:20

History, 13.10.2019 12:20

Biology, 13.10.2019 12:20

Mathematics, 13.10.2019 12:20

Mathematics, 13.10.2019 12:20

Mathematics, 13.10.2019 12:20