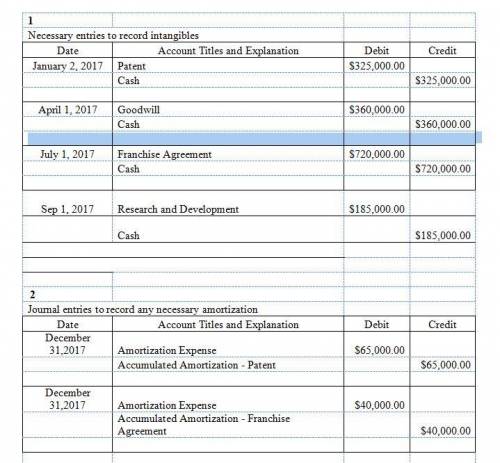

Nelson company, organized in 2017, has these transactions related to intangible assets in that year: jan. 2 purchased a patent (5-year life) $325,000. apr. 1 goodwill purchased (indefinite life) $360,000. july 1 acquired a 9-year franchise; expiration date july 1, 2026, $720,000. sept. 1 research and development costs $185,000.

1. prepare the necessary entries to record these intangibles. all costs were for cash.

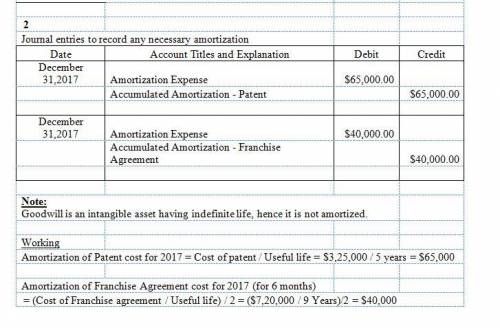

2. make the entries as of december 31, 2017, recording any necessary amortization.

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Goods and services that can be used for the same purpose are and goods and services that are used together are

Answers: 1

Business, 22.06.2019 20:20

You are the cfo of a u.s. firm whose wholly owned subsidiary in mexico manufactures component parts for your u.s. assembly operations. the subsidiary has been financed by bank borrowings in the united states. one of your analysts told you that the mexican peso is expected to depreciate by 30 percent against the dollar on the foreign exchange markets over the next year. what actions, if any, should you take

Answers: 2

Business, 22.06.2019 20:20

Trade will take place: a. if the maximum that a consumer is willing and able to pay is less than the minimum price the producer is willing and able to accept for a good. b. if the maximum that a consumer is willing and able to pay is greater than the minimum price the producer is willing and able to accept for a good. c. only if the maximum that a consumer is willing and able to pay is equal to the minimum price the producer is willing and able to accept for a good. d. none of the above.

Answers: 3

You know the right answer?

Nelson company, organized in 2017, has these transactions related to intangible assets in that year:...

Questions

Computers and Technology, 18.01.2020 00:31