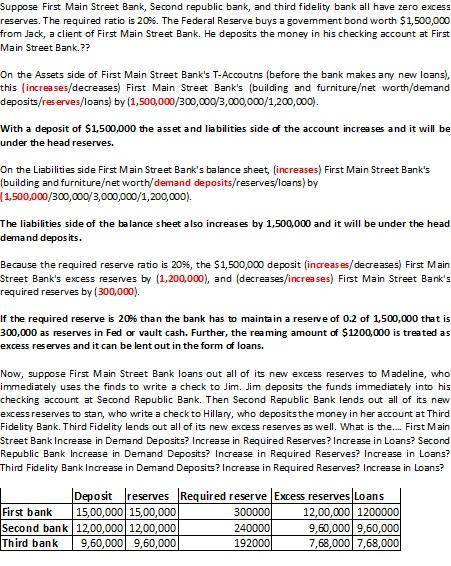

Suppose first main street bank, second republic bank, and third fidelity bank all have zero excess reserves. the required ratio is 20%. the federal reserve buys a government bond worth $1,500,000 from jack, a client of first main street bank. he deposits the money in his checking account at first main street on the assets side of first main street bank's t-accoutns (before the bank makes any new loans), this (increases/decreases) first main street bank's (building and furniture/net worth/demand deposits/reserves/loans) by (1,500,000/300,000/3,000,000/1,200, 000). on the liabilities side first main street bank's balance sheet, (increases/decreases) first main street bank's (building and furniture/net worth/demand deposits/reserves/loans) by (1,500,000/300,000/3,000,000/1,200, 000). because the required reserve ratio is 20%, the $1,500,000 deposit (increases/decreases) first main street bank's excess reserves by (1,200,000/0/900,000/300,000), and (decreases/increases) first main street bank's required reserves by (1,200,000/0/900,000/300,000), now, suppose first main street bank loans out all of its new excess reserves to madeline, who immediately uses the finds to write a check to jim. jim deposits the funds immediately into his checking account at second republic bank. then second republic bank lends out all of its new excess reserves to stan, who write a check to hillary, who deposits the money in her account at third fidelity bank. third fidelity lends out all of its new excess reserves as well. what is the

Answers: 1

Another question on Business

Business, 21.06.2019 23:50

Juan has a retail business selling skateboard supplies he maintains large stockpiles of every item he sells in a warehouse on the outskirts of town he keeps finding that he has to reorder certain supplies all the time but others only once a year how can he solve this problem?

Answers: 1

Business, 22.06.2019 11:00

The following transactions occurred during july: received $1,000 cash for services provided to a customer during july. received $4,000 cash investment from bob johnson, the owner of the business received $850 from a customer in partial payment of his account receivable which arose from sales in june. provided services to a customer on credit, $475. borrowed $7,000 from the bank by signing a promissory note. received $1,350 cash from a customer for services to be rendered next year. what was the amount of revenue for july?

Answers: 1

Business, 22.06.2019 17:50

Variable rate cd’s = $90 treasury bills = $150 discount loans = $20 treasury notes = $100 fixed rate cds = $160 money market deposit accts. = $140 savings deposits = $90 fed funds borrowing = $40 variable rate mortgage loans $140 demand deposits = $40 primary reserves = $50 fixed rate loans = $210 fed funds lending = $50 equity capital = $120 a. develop a balance sheet from the above data. be sure to divide your balance sheet into rate-sensitive assets and liabilities as we did in class and in the examples. b. perform a standard gap analysis and a duration analysis using the above data if you have a 1.15% decrease in interest rates and an average duration of assets of 5.4 years and an average duration of liabilities of 3.8 years. c. indicate if this bank will remain solvent after the valuation changes. if so, indicate the new level of equity capital after the valuation changes. if not, indicate the amount of the shortage in equity capital.

Answers: 3

Business, 22.06.2019 19:40

On april 1, santa fe, inc. paid griffith publishing company $2,448 for 36-month subscriptions to several different magazines. santa fe debited the prepayment to a prepaid subscriptions account, and the subscriptions started immediately. what amount should appear in the prepaid subscription account for santa fe, inc. after adjustments on december 31 of the first year assuming the company is using a calendar-year reporting period and no previous adjustment has been made?

Answers: 1

You know the right answer?

Suppose first main street bank, second republic bank, and third fidelity bank all have zero excess r...

Questions

Biology, 06.03.2020 23:15

Mathematics, 06.03.2020 23:15

History, 06.03.2020 23:15

Biology, 06.03.2020 23:15

Mathematics, 06.03.2020 23:15

Mathematics, 06.03.2020 23:15

Mathematics, 06.03.2020 23:15

History, 06.03.2020 23:15

Mathematics, 06.03.2020 23:16

History, 06.03.2020 23:16

Advanced Placement (AP), 06.03.2020 23:16