Business, 22.11.2019 23:31 angelica19carmona

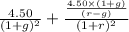

The border crossing just paid an annual dividend of $4.20 per share and is expected to pay annual dividends of $4.40 and $4.50 per share the next two years, respectively. after that, the firm expects to maintain a constant dividend growth rate of 2 percent per year. what is the value of this stock today if the required return is 14 percent?

a. $30.04

b. $32.18

c. $33.33

d. $35.80

e. $36.75.

Answers: 1

Another question on Business

Business, 22.06.2019 19:00

The demand curve determines equilibrium price in a market. is a graphical representation of the relationship between price and quantity demanded. depicts the relationship between production costs and output. is a graphical representation of the relationship between price and quantity supplied.

Answers: 1

Business, 22.06.2019 20:30

When patey pontoons issued 4% bonds on january 1, 2018, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. the bonds mature december 31, 2021 (4 years). interest is paid semiannually on june 30 and december 31?

Answers: 1

Business, 23.06.2019 00:00

What is a sales lead? a. an employee on the customer service team who deals with existing customers b. a sales person who works on a residual commission structure c. an expert in maslow's hierarchy of needs d. a potential customer who has shown interest in the company's product

Answers: 1

Business, 23.06.2019 14:00

In some markets, the government regulates the price of utilities so that they are not priced out of range of peoples ability to pay. this is a example a/an

Answers: 2

You know the right answer?

The border crossing just paid an annual dividend of $4.20 per share and is expected to pay annual di...

Questions

Mathematics, 05.04.2021 21:30

Mathematics, 05.04.2021 21:30

Mathematics, 05.04.2021 21:30

Physics, 05.04.2021 21:30

Biology, 05.04.2021 21:40

History, 05.04.2021 21:40

Mathematics, 05.04.2021 21:40

Social Studies, 05.04.2021 21:40

Physics, 05.04.2021 21:40

Mathematics, 05.04.2021 21:40

Biology, 05.04.2021 21:40

History, 05.04.2021 21:40

+

+

+

+  +

+