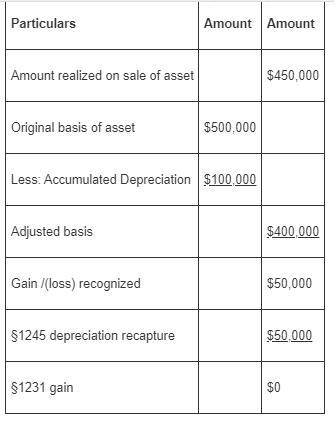

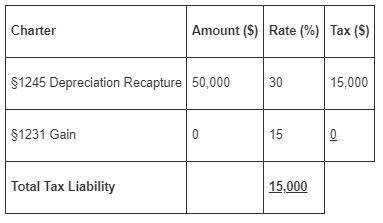

Hart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deductions against the asset. hart has a marginal tax rate of 32 percent. answer the questions presented in the following alternative scenarios (assume hart had no property transactions other than those described in the problem): (loss amounts should be indicated by a minus sign. enter na if a situation is not applicable. leave no answer blank. enter zero if applicable.) required: a1. what is the amount and character of hart’s recognized gain or loss if the asset is tangible personal property sold for $450,000? a2. due to this sale, what tax effect does hart have for the year?

Answers: 3

Another question on Business

Business, 22.06.2019 05:30

Financial information that is capable of making a difference in a decision is

Answers: 3

Business, 22.06.2019 08:30

Uppose that the federal reserve purchases a bond for $100,000 from donald truck, who deposits the proceeds in the manufacturer’s national bank. what will be the impact of this purchase on the supply of money? the money supply will increase by $100,000. the money supply will increase by $80,000. the money supply will increase by $500,000. this action will have no effect on the money supply. if the reserve requirement ratio is 20 percent, what is the maximum amount of additional loans that the manufacturer’s bank will be able to extend as the result of truck’s deposit? the maximum additional loans is $100,000. the maximum additional loans is $80,000. the maximum additional loans is $20,000. the maximum additional loans is $500,000. given the 20 percent reserve requirement, what is the maximum increase in the quantity of checkable deposits that could result throughout the entire banking system because of the fed’s action? this action will have no effect on the money supply. the money supply will eventually increase by $80,000. the money supply will eventually increase by $500,000. the money supply will eventually increase by $100,000.

Answers: 1

Business, 22.06.2019 14:30

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Business, 22.06.2019 19:20

Win goods inc. is a large multinational conglomerate. as a single business unit, the company's stock price is estimated to be $200. however, by adding the actual market stock prices of each of its individual business units, the stock price of the company as one unit would be $300. what is win goods experiencing in this scenario? a. diversification discount b. learning-curveeffects c. experience-curveeffects d. economies of scale

Answers: 1

You know the right answer?

Hart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deduction...

Questions

Mathematics, 18.03.2021 02:00

Biology, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Social Studies, 18.03.2021 02:00

English, 18.03.2021 02:00

Health, 18.03.2021 02:00

Social Studies, 18.03.2021 02:00

History, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00

Mathematics, 18.03.2021 02:00