Business, 22.11.2019 01:31 iicekingmann

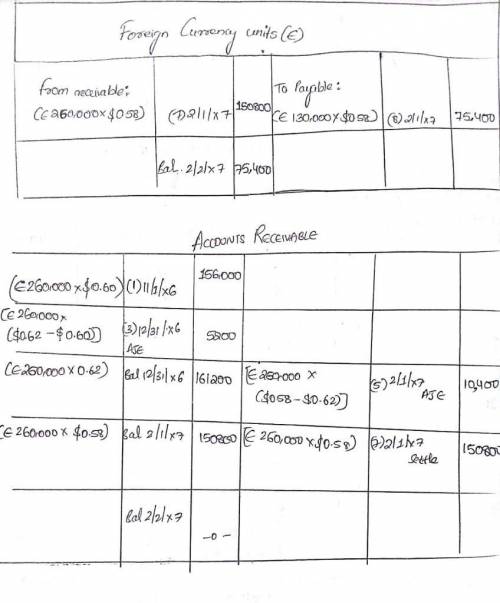

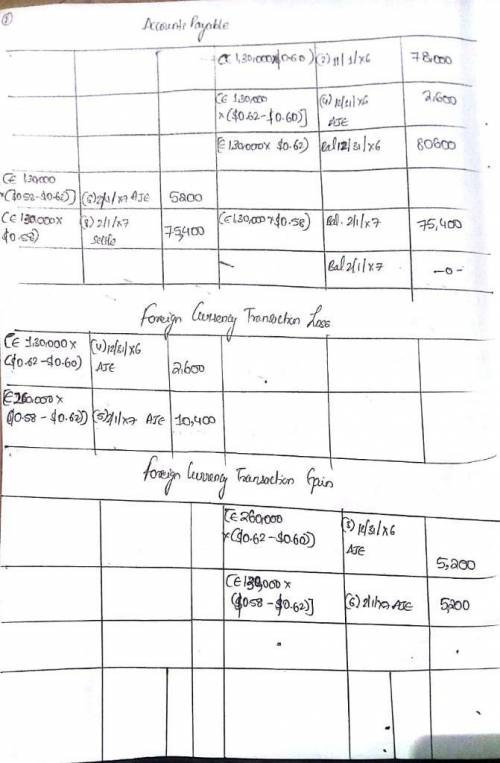

Merchant company had the following foreign currency transactions: on november 1, 20x6, merchant sold goods to a company located in munich, germany. the receivable was to be settled in european euros on february 1, 20x7, with the receipt of €190,000 by merchant company. on november 1, 20x6, merchant purchased machine parts from a company located in berlin, germany. merchant is to pay €95,000 on february 1, 20x7. the direct exchange rates are as follows: november 1, 20x6 €1 = $ 0.60 december 31, 20x6 €1 = $ 0.62 february 1, 20x7 €1 = $ 0.58 required: record the t-accounts for the following transactions (record the transactions in the given order.) the november 1, 20x6, export transaction (sale). the november 1, 20x6, import transaction (purchase). the december 31, 20x6, year-end adjustment required of the foreign currency–denominated receivable of €190,000. the december 31, 20x6, year-end adjustment required of the foreign currency–denominated payable of €95,000. the february 1, 20x7, adjusting entry to determine the u. s. dollar–equivalent value of the foreign currency receivable on that date. the february 1, 20x7, adjusting entry to determine the u. s. dollar–equivalent value of the foreign currency payable on that date. the february 1, 20x7, settlement of the foreign currency receivable. the february 1, 20x7, settlement of the foreign currency payable.

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Balance sheet the assets of dallas & associates consist entirely of current assets and net plant and equipment. the firm has total assets of $2 5 million and net plant and equipment equals $2 million. it has notes payable of $150,000, long-term debt of $750,000, and total common equity of $1 5 million. the firm does have accounts payable and accruals on its balance sheet. the firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. a. what is the company's total debt? b. what is the amount of total liabilities and equity that appears on the firm's balance sheet? c. what is the balance of current assets on the firm's balance sheet? d. what is the balance of current liabilities on the firm's balance sheet? e. what is the amount of accounts payable and accruals on its balance sheet? [hint: consider this as a single line item on the firm's balance sheet.] f. what is the firm's net working capital? g. what is the firm's net operating working capital? h. what is the explanation for the difference in your answers to parts f and g?

Answers: 1

Business, 22.06.2019 07:30

Select the correct answer the smith family adopted a child. the adoption procedure took about three months, and the family incurred various expenses. will the smiths receive and financial benefit for the taxable year? a) they will not receive any financial benefit for adopting the child b) their income tax component will decrease c) they will receive childcare grants d) they will receive a tax credit for the cost borne for adopting the child e) they will receive several tax deductions

Answers: 3

Business, 22.06.2019 08:30

Kiona co. set up a petty cash fund for payments of small amounts. the following transactions involving the petty cash fund occurred in may (the last month of the company's fiscal year). may 1 prepared a company check for $350 to establish the petty cash fund. 15 prepared a company check to replenish the fund for the following expenditures made since may 1. a. paid $109.20 for janitorial services. b. paid $89.15 for miscellaneous expenses. c. paid postage expenses of $60.90. d. paid $80.01 to the county gazette (the local newspaper) for an advertisement. e. counted $26.84 remaining in the petty cashbox. 16 prepared a company check for $200 to increase the fund to $550. 31 the petty cashier reports that $380.27 cash remains in the fund. a company check is drawn to replenish the fund for the following expenditures made since may 15. f. paid postage expenses of $59.10. g. reimbursed the office manager for business mileage, $47.05. h. paid $48.58 to deliver merchandise to a customer, terms fob destination. 31 the company decides that the may 16 increase in the fund was too large. it reduces the fund by $50, leaving a total of $500.

Answers: 1

Business, 22.06.2019 09:30

Darlene has a balance of 3980 on a credit card with an apr of 22.8% paying off her balance and which of these lengths of time will result in her paying the least amount of interest?

Answers: 2

You know the right answer?

Merchant company had the following foreign currency transactions: on november 1, 20x6, merchant sol...

Questions

Mathematics, 06.05.2020 05:27

Mathematics, 06.05.2020 05:27

Geography, 06.05.2020 05:27

English, 06.05.2020 05:27