The rivoli company has no debt outstanding, and its financial position is given by the following data:

assets (book = market) 300,000

ebit 500,000,

cost of equity, rs 10%

stock price, po $15

shares outstanding, no 200,000

tax rate, t 40%

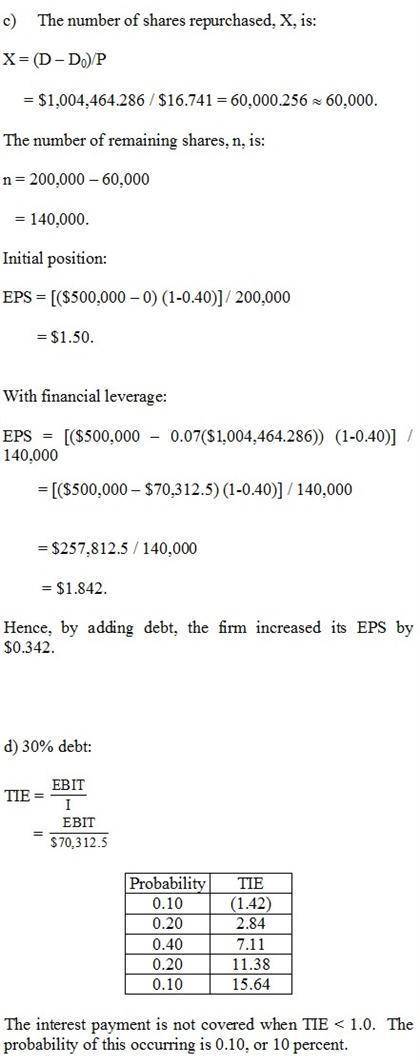

the firm is considering selling bonds and simultaneously repurchasing some of its stock. if it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 11% to reflect the increased risk. bonds can be sold at a cost rd of 7%. rivoli is a no growth firm. hence, all its earnings are paid out as dividends. earnings are expected to be constant over time.

a.) what effect would this use of leverage have on the value of the firm:

b.) what would be the price of rivoli’s stock?

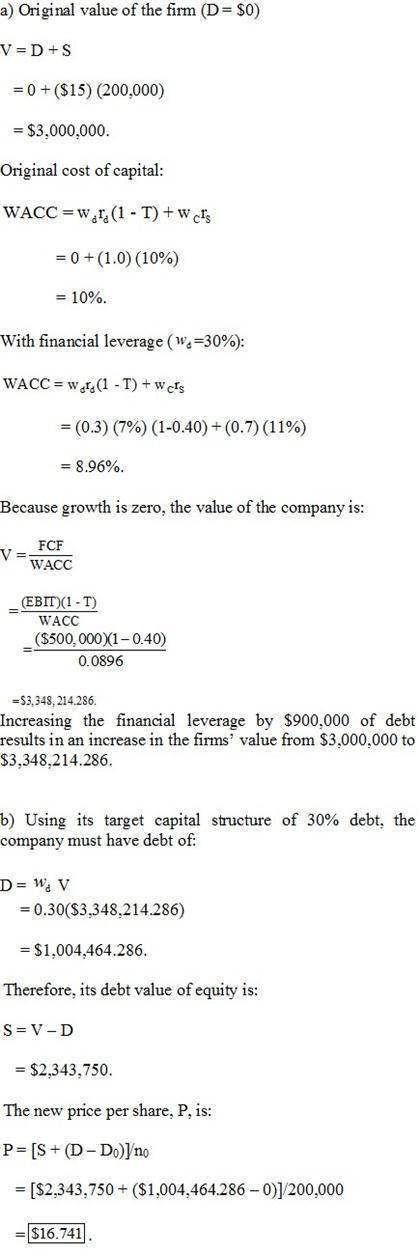

c.) what happens to the firm’s earnings per share after the recapitalization?

d.) the $500,000 ebit given previously is actually the expected value from the following probability distribution:

probability ebit

0.1 100,000

0.2 200,000

0.4 500,000

0.2 800,000

0.1 1,100,000

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

Business, 22.06.2019 10:30

What are the positive environmental trends seen today? many industries are taking measures to reduce the use( _gold,carbon dioxide,ozone_) of -depleting substances and are turning to(_scarce,renewable,non-recyclable_) energy sources though they may seem expensive. choose one of those 3 option to fill the

Answers: 3

Business, 22.06.2019 15:00

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 2

Business, 22.06.2019 20:10

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept,the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year.to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

You know the right answer?

The rivoli company has no debt outstanding, and its financial position is given by the following dat...

Questions

Geography, 29.09.2020 14:01

Arts, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Biology, 29.09.2020 14:01

Biology, 29.09.2020 14:01

Mathematics, 29.09.2020 14:01

Biology, 29.09.2020 14:01