Southern corporation has a capital structure of 40% debt and 60% common equity. this capital structure is expected not to change. the firm's tax rate is 34%. the firm can issue the following securities to finance capital investments:

debt: capital can be raised through bank loans at a pretax cost of 8.5%. also, bonds can be issued at a pretax cost of 10%.

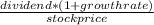

common stock: retained earnings will be available for investment. in addition, new common stock can be issued at the market price of $59. flotation costs will be $3 per share. the recent common stock dividend was $3.15. dividends are expected to grow at 7% in the future.

what is the cost of capital if the firm uses bank loans and retained earnings?

a. 9.9%

b. 10.3%

c. 12.6%

d. 11.8%

e. 10.4%

Answers: 2

Another question on Business

Business, 22.06.2019 22:10

Which of the following is usually not one of the top considerations in choosing a country for a facility location? a. availability of labor and labor productivityb. attitude of governmental unitsc. location of marketsd. zoning regulationse. exchange rates

Answers: 1

Business, 23.06.2019 07:30

What criteria does a company have to meet to be considered a monopoly?

Answers: 2

Business, 23.06.2019 09:30

Which of the following economic behaviors causes scarcity? a limited supply and unlimited demand b limited supply and unlimited credit c limited supply and limited regulation d limited supply and limited incentives

Answers: 1

You know the right answer?

Southern corporation has a capital structure of 40% debt and 60% common equity. this capital structu...

Questions

Mathematics, 06.05.2020 20:32

Mathematics, 06.05.2020 20:32

Mathematics, 06.05.2020 20:32

Mathematics, 06.05.2020 20:32

Biology, 06.05.2020 20:32

Health, 06.05.2020 20:32

Mathematics, 06.05.2020 20:32

English, 06.05.2020 20:32

Mathematics, 06.05.2020 20:32

+ growth rate ........................1

+ growth rate ........................1 + 0.07

+ 0.07