Business, 21.11.2019 03:31 vlactawhalm29

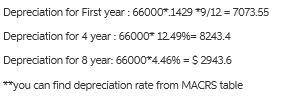

Adigitally controlled plane for manufacturing furniture (macrs-gds 7-year property) is purchased on april 1 by a calendar-year taxpayer for $66,000. it is expected to last 12 years and have a salvage value of $5,000. calculate the depreciation deduction during years 1, 4, and 8 using macrs-gds allowances.

Answers: 2

Another question on Business

Business, 21.06.2019 13:30

There are about 6.8 billion people in the world, and about 11.4 billion usable hectares. currently, the population of the united states has an ecological footprint of about 9.0 hectares per person. if all people in the world were to live at the level of consumption found in the united states, the population of the world would have to in order to support them.

Answers: 1

Business, 22.06.2019 10:30

You meet that special person and get married. amazingly your spouse has exactly the same income you do 47,810. if your tax status is now married filing jointly what is your tax liability

Answers: 2

Business, 22.06.2019 17:10

Calculate riverside’s financial ratios for 2014. assume that riverside had $1,000,000 in lease payments and $1,400,000 in debt principal repayments in 2014. (hint: use the book discussion to identify the applicable ratios.)

Answers: 3

Business, 22.06.2019 19:50

What is the present value of the following cash flow stream at a rate of 12.0%? years: 0 1 2 3 4| | | | |cfs: $0 $1,500 $3,000 $4,500 $6,000a. $9,699b. $10,210c. $10,747d. $11,284e. $11,849

Answers: 3

You know the right answer?

Adigitally controlled plane for manufacturing furniture (macrs-gds 7-year property) is purchased on...

Questions

Advanced Placement (AP), 23.06.2019 10:30

Biology, 23.06.2019 10:30

History, 23.06.2019 10:30

History, 23.06.2019 10:30

History, 23.06.2019 10:30

History, 23.06.2019 10:30

Mathematics, 23.06.2019 10:30

History, 23.06.2019 10:30

English, 23.06.2019 10:30

Mathematics, 23.06.2019 10:30