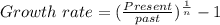

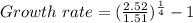

Seagate technology is a global leader in data storage solutions and a high-yield dividend payer. from 2015 through 2019, seagate paid the following per-share dividends: year dividend per share 2019 $2.52 2018 2.23 2017 1.82 2016 1.15 2015 1.51 assume that the historical annual growth rate of seagate dividends is an accurate estimate of the future constant annual dividend growth rate. use a 21% required rate of return to find the value of seagate's stock immediately after it paid its 2019 dividend of $2.52.

Answers: 3

Another question on Business

Business, 21.06.2019 19:00

Spirula trading inc sublets a part of its offices building to jade inc. for a period of ten years . where will the company disclose this information?

Answers: 3

Business, 22.06.2019 05:50

Match the steps for conducting an informational interview with the tasks in each step.

Answers: 1

Business, 22.06.2019 10:00

Which term best fits the sentence? is the process of reasoning, analyzing, and making important decisions. it’s an important skill in making career decisions. a. critical thinking b. weighing pros and cons c. goal setting

Answers: 1

Business, 22.06.2019 12:20

Bdj co. wants to issue new 22-year bonds for some much-needed expansion projects. the company currently has 9.2 percent coupon bonds on the market that sell for $1,132, make semiannual payments, have a $1,000 par value, and mature in 22 years. what coupon rate should the company set on its new bonds if it wants them to sell at par?

Answers: 3

You know the right answer?

Seagate technology is a global leader in data storage solutions and a high-yield dividend payer. fro...

Questions

Physics, 20.03.2020 10:54