Business, 14.11.2019 04:31 hhhhhh8897

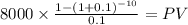

The oviedo company is considering the purchase of a new machine to replace an obsolete one. the machine being used for the operation has a book value and a market value of zero. however, the machine is in good working order and will last at least another 10 years. the proposed replacement machine will perform the operation so much more efficiently that oviedo’s engineers estimate that it will produce after-tax cash flows (labor savings) of $8,000 per year. the after-tax cost of the new machine is $45,000, and its economic life is estimated to be 10 years. it has zero salvage value. the firm’s wacc is 10%, and its marginal tax rate is 25%. should oviedo buy the new machine?

Answers: 1

Another question on Business

Business, 22.06.2019 19:50

Right medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. based on industry experience with similar product introductions, warranty costs are expected to approximate 2% of sales. sales were $8 million and actual warranty expenditures were $42,750 for the first year of selling the product. what amount (if any) should right report as a liability at the end of the year?

Answers: 2

Business, 22.06.2019 20:00

Ryngard corp's sales last year were $38,000, and its total assets were $16,000. what was its total assets turnover ratio (tato)? a. 2.04b. 2.14c. 2.26d. 2.38e. 2.49

Answers: 1

Business, 22.06.2019 20:20

Amanager of a store that sells and installs spas wants to prepare a forecast for january and june of next year. her forecasts are a combination of trend and seasonality. she uses the following equation to estimate the trend component of monthly demand: ft = 30+5t, where t = 1 in january of this year. seasonal relatives are 0.60 for january and 1.50 for june. what demands should she predict for january and june of next year

Answers: 2

Business, 22.06.2019 20:20

As you have noticed, the demand for flip phones has drastically reduced, and there are only a few consumer electronics companies selling them at extremely low prices. also, the current buyers of flip phones are mainly categorized under laggards. which of the following stages of the industry life cycle is the flip phone industry in currently? a. growth stage b. maturity stage c. decline stage d. commercialization stage

Answers: 2

You know the right answer?

The oviedo company is considering the purchase of a new machine to replace an obsolete one. the mach...

Questions

Mathematics, 05.05.2020 20:13

Mathematics, 05.05.2020 20:13

History, 05.05.2020 20:13

Chemistry, 05.05.2020 20:13

English, 05.05.2020 20:13

Chemistry, 05.05.2020 20:13

History, 05.05.2020 20:13

Mathematics, 05.05.2020 20:13

Biology, 05.05.2020 20:13