Business, 11.11.2019 22:31 Theresab2021

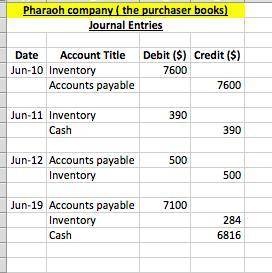

On june 10, pharoah company purchased $7,600 of merchandise from cullumber company, terms 4/10, n/30. pharoah company pays the freight costs of $390 on june 11. goods totaling $500 are returned to cullumber company for credit on june 12. on june 19, pharoah company pays cullumber company in full, less the purchase discount. both companies use a perpetual inventory system. (a) prepare separate entries for each transaction on the books of pharoah company. (if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when amount is entered. do not indent manually. record journal entries in the order presented in the problem.) (b) the parts of this question must be completed in order. this part will be available when you complete the part above.

Answers: 1

Another question on Business

Business, 21.06.2019 23:00

James has set the goal of achieving all "a"s during this year of school.which term best describes this goal

Answers: 2

Business, 22.06.2019 03:00

For each separate case below, follow the 3-step process for adjusting the prepaid asset account at december 31. step 1: determine what the current account balance equals. step 2: determine what the current account balance should equal. step 3: record the december 31 adjusting entry to get from step 1 to step 2. assume no other adjusting entries are made during the year. a. prepaid insurance. the prepaid insurance account has a $4,700 debit balance to start the year. a re- view of insurance policies and payments shows that $900 of unexpired insurance remains at year-end. b. prepaid insurance. the prepaid insurance account has a $5,890 debit balance at the start of the year. a review of insurance policies and payments shows $1,040 of insurance has expired by year-end. c.prepaidrent.onseptember1ofthecurrentyear,thecompanyprepaid$24,000 for 2 years of rentfor facilities being occupied that day. the company debited prepaid rent and credited cash for $24,000.

Answers: 3

Business, 22.06.2019 06:00

For 2018, rahal's auto parts estimates bad debt expense at 1% of credit sales. the company reported accounts receivable and an allowance for uncollectible accounts of $86,500 and $2,100, respectively, at december 31, 2017. during 2018, rahal's credit sales and collections were $404,000 and $408,000, respectively, and $2,340 in accounts receivable were written off.rahal's accounts receivable at december 31, 2018, are:

Answers: 2

Business, 22.06.2019 11:10

Robert black, regional manager for ford in texas and oklahoma, faced a dilemma. the ford f-150 pickup truck was the best-selling pickup ever, yet ford's headquarters in detroit had decided to introduce a completely redesigned f-150. how could mr. black sell both trucks at the same time? he still had "old" f-150s in stock. in his advertising, mr. black referred to the new f-150s as follows: "not a better f-150. just the only truck good enough to be the next f-150." this statement represents ford's of the new f-150.

Answers: 2

You know the right answer?

On june 10, pharoah company purchased $7,600 of merchandise from cullumber company, terms 4/10, n/30...

Questions

Mathematics, 18.11.2020 21:50

English, 18.11.2020 21:50

English, 18.11.2020 21:50

History, 18.11.2020 21:50

Arts, 18.11.2020 21:50

Social Studies, 18.11.2020 21:50

Mathematics, 18.11.2020 21:50

Social Studies, 18.11.2020 21:50

History, 18.11.2020 21:50

Mathematics, 18.11.2020 21:50

Mathematics, 18.11.2020 21:50

English, 18.11.2020 21:50

History, 18.11.2020 21:50

Mathematics, 18.11.2020 21:50

History, 18.11.2020 21:50

Mathematics, 18.11.2020 21:50