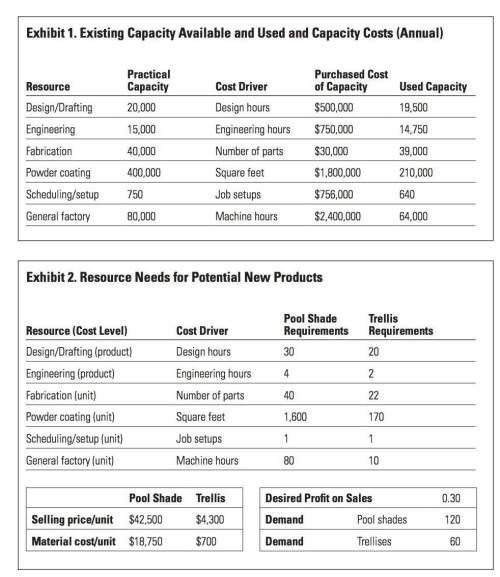

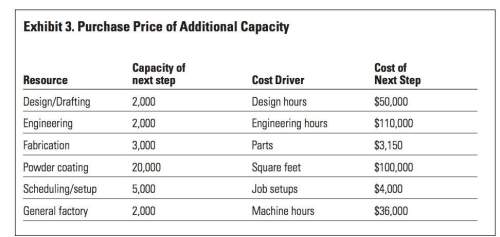

Resource spending approach: assume the decisions to make pool shades and trellises are considered to be a short-term decision and that chandler would make these products one at a time when time is available, so as not to not delay any of the custom orders. because there is excess capacity on current production equipment, the company wants to use a tactical decision (resource spending) approach to evaluate the decision to make the products. exhibit 3 provides information about the cost to purchase additional resources. a. compute the net change in cash flow of making and selling the full demand of pool shades. b. compute the net change in cash flow of making and selling the full demand of trellises. c. compute the net change in cash flow of making the full demand for both the pool shades and the trellises. d. given the assumptions aforementioned (such as short-term and excess capacity), would chandler’s management choose to make either or both of the products? explain your answer.

Answers: 3

Another question on Business

Business, 21.06.2019 22:20

Why should you not sign the tenant landlord agreement quickly and immediately

Answers: 1

Business, 22.06.2019 10:00

Marco works in the marketing department of a luxury fashion brand. he is making a presentation on the success of a recent marketing campaign that included a fashion show. which slide elements can he use to include photographs and footage of the fashion show in his presentation? marco can use the: table images audio option to include photographs and the: flowcharts images video option to include footage of the fashion show.

Answers: 1

Business, 22.06.2019 16:00

Analyzing and computing accrued warranty liability and expense waymire company sells a motor that carries a 60-day unconditional warranty against product failure. from prior years' experience, waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. during the current period, waymire sold 69,000 units and repaired 1,000 units. (a) how much warranty expense must waymire report in its current period income statement? (b) what warranty liability related to current period sales will waymire report on its current period-end balance sheet? (hint: remember that some units were repaired in the current period.) (c) what analysis issues must we consider with respect to reported warranty liabilities?

Answers: 1

You know the right answer?

Resource spending approach: assume the decisions to make pool shades and trellises are considered t...

Questions

Mathematics, 26.06.2020 15:01

History, 26.06.2020 15:01

Chemistry, 26.06.2020 15:01

Mathematics, 26.06.2020 15:01

Mathematics, 26.06.2020 15:01

Biology, 26.06.2020 15:01

Mathematics, 26.06.2020 15:01

Mathematics, 26.06.2020 15:01

Health, 26.06.2020 15:01

Mathematics, 26.06.2020 15:01

Mathematics, 26.06.2020 15:01