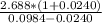

Portman industires just paid a divident of $2.40 per share. the company expects the coming year to be very profitable, and its dividend is expected to grow by 12.00% over the next year. after teh next year, though, portman's divident is expected to grow at a constant rate of 2.40% per year. the risk free rate is 3.00%, the market risk premium is 3.60% and pormans beta is 1.90.assuming taht the market is in equilibriumwhat are the dividends one year from is the horizon is the intrinsic value of portman's is the expected dividend yield for portmant stock today? a. 5.95%

b. 7.44%

c. 7.26%

d. 7.98%

Answers: 3

Another question on Business

Business, 21.06.2019 16:00

Sarah borrowed $16,500 on may 23 with interest due on september 3. if the interest rate is 9%, find the interest on the loan using exact interest and ordinary interest.

Answers: 2

Business, 22.06.2019 03:30

When the federal reserve buys and sells bonds to member banks, it is called a. monetary policy b. reserve ratio c. interest rate adjustment d. open market operations

Answers: 2

Business, 22.06.2019 10:00

Employees at a library check out books to patrons. books have an isbn and a name. the library sometimes has multiple copies of the same book. books have one or more authors. a patron is an individual who has an active (non-expired) library card. for each library card, we store the person's first and last names and their address. for each employee, we store their employee id, current salary, first and last name and their address. we also store the employee id of their current manager. each time we check out a book to a patron we need to store the date of the transaction, the employee who checked out the book to the patron, and the library card of the patron. some employees have library cards. if an employee patron turns in a book late, the fine that they pay is a percentage of their salary. some employees are authors who have library cards—they are allowed to check out as many books as they like.

Answers: 1

Business, 22.06.2019 22:10

jackie's snacks sells fudge, caramels, and popcorn. it sold 12,000 units last year. popcorn outsold fudge by a margin of 2 to 1. sales of caramels were the same as sales of popcorn. fixed costs for jackie's snacks are $14,000. additional information follows: product unit sales prices unit variable cost fudge $5.00 $4.00 caramels $8.00 $5.00 popcorn $6.00 $4.50 the breakeven sales volume in units for jackie's snacks is

Answers: 1

You know the right answer?

Portman industires just paid a divident of $2.40 per share. the company expects the coming year to b...

Questions

English, 28.09.2019 03:30

Mathematics, 28.09.2019 03:30

Social Studies, 28.09.2019 03:30

Chemistry, 28.09.2019 03:30

Advanced Placement (AP), 28.09.2019 03:30

Biology, 28.09.2019 03:30

Biology, 28.09.2019 03:30

Health, 28.09.2019 03:30

History, 28.09.2019 03:30

Mathematics, 28.09.2019 03:30

Mathematics, 28.09.2019 03:30

..................3

..................3

...................4

...................4

......................5

......................5