Business, 10.11.2019 01:31 live4dramaoy0yf9

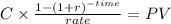

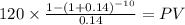

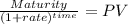

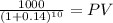

Two years ago, trans-atlantic airlines sold a $250 million bond issue to finance the purchase of new jet airliners. these bonds were issued in $1000 denominations with an original maturity of 12 years and a coupon rate of 12%. determine the value today of one of these bonds to an investor who requires a 14% rate of return on these securities.

Answers: 2

Another question on Business

Business, 21.06.2019 17:10

Which term refers to the amount of products generated divided by the inputs necessary to create that output? a. performance b. industry ranking c. productivity d. organizational performance e. organizational effectiveness

Answers: 1

Business, 22.06.2019 09:30

When you hire an independent contractor you don't have to pay the contractors what

Answers: 3

Business, 22.06.2019 21:20

Which of the following best explains why large companies pay less for goods from wholesalers? a. large companies are able to pay for the goods they purchase in cash. b. large companies are able to increase the efficiency of wholesale production. c. large companies can buy all or most of a wholesaler's stock. d. large companies have better-paid employees who are better negotiators.

Answers: 2

Business, 23.06.2019 01:30

Jodie lives in a developing nation where the local markets are underdeveloped in terms of domestic exposure. her country wants to boost these domestic industries in the face of heavy competition from foreign players in the market. which trade practice should jodie’s country adopt to shield its domestic industries from foreign players? jodie’s country should adopt to shield its domestic industries from foreign players. typing answer

Answers: 1

You know the right answer?

Two years ago, trans-atlantic airlines sold a $250 million bond issue to finance the purchase of new...

Questions

Mathematics, 05.11.2019 22:31

English, 05.11.2019 22:31

SAT, 05.11.2019 22:31

Computers and Technology, 05.11.2019 22:31

Mathematics, 05.11.2019 22:31

Mathematics, 05.11.2019 22:31

Mathematics, 05.11.2019 22:31

Mathematics, 05.11.2019 22:31

Mathematics, 05.11.2019 22:31