Business, 09.11.2019 04:31 parapraxis

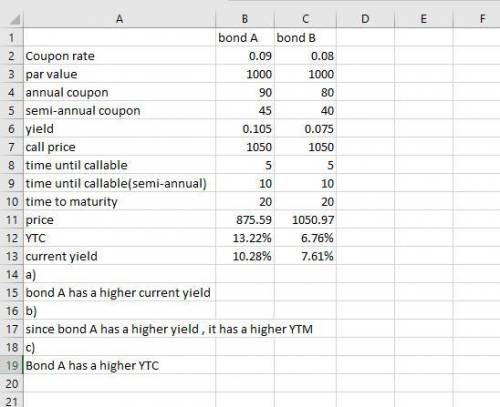

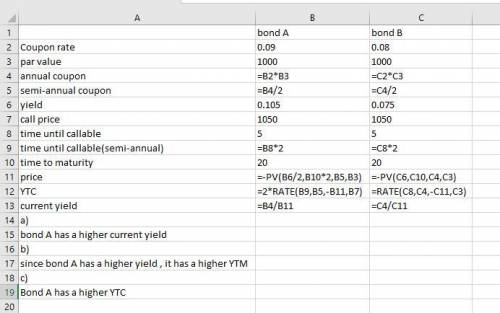

Assume that an investor is looking at two bonds: bond a is a 20-year, 9% (semiannual pay) bond that is priced to yield 10.5%. bond b is a 20-year, 8% (annual pay) bond that is priced to yield 7.5%. both bonds carry 5-year call deferments and call prices (in 5 years) of $1,050. which bond has the higher current yield?

Answers: 3

Another question on Business

Business, 21.06.2019 18:20

Write two goals for yourself that will aid you in pursuing your post-secondary education or training. with this

Answers: 1

Business, 21.06.2019 22:30

Emily sold the following investments during the year: stock date purchased date sold sales price cost basis a. 1,000 shares dot com co. 03-21-2007 02-04-2018 $20,000 $5,000 b. 500 shares big box store 05-19-2017 01-22-2018 $8,200 $7,500 c. 300 shares lotta fun, inc. 10-02-2017 09-21-2018 $3,000 $4,500 d. 700 shares local gas co. 06-17-2017 11-11-2018 $14,000 $17,000 for each stock, calculate the amount and the nature of the gain or loss.

Answers: 3

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

Business, 22.06.2019 10:50

Bill dukes has $100,000 invested in a 2-stock portfolio. $62,500 is invested in stock x and the remainder is invested in stock y. x's beta is 1.50 and y's beta is 0.70. what is the portfolio's beta? do not round your intermediate calculations. round the final answer to 2 decimal places.

Answers: 2

You know the right answer?

Assume that an investor is looking at two bonds: bond a is a 20-year, 9% (semiannual pay) bond that...

Questions

Mathematics, 10.07.2021 21:50

Mathematics, 10.07.2021 21:50

Mathematics, 10.07.2021 21:50

Mathematics, 10.07.2021 21:50

Biology, 10.07.2021 22:00

Computers and Technology, 10.07.2021 22:00

English, 10.07.2021 22:00

Mathematics, 10.07.2021 22:00

Social Studies, 10.07.2021 22:00

Mathematics, 10.07.2021 22:00

English, 10.07.2021 22:00

Mathematics, 10.07.2021 22:00

Mathematics, 10.07.2021 22:00

Mathematics, 10.07.2021 22:00

Mathematics, 10.07.2021 22:00