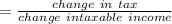

Arlene is single and has taxable income of $18,000. her tax liability is currently $2,236. she has the opportunity to earn an additional $5,000 if she accepts and completes a special project at work. there are no additional expenses to offset the $5,000 income. consequently, arlene will have a tax liability of $2,986 if she accepts the special project. arlene has a marginal tax rate of

Answers: 2

Another question on Business

Business, 22.06.2019 03:30

Used cars usually have options: higher depreciation rate than new cars lower financing costs than new cars lower insurance premiums than new cars lower maintenance costs than new cars

Answers: 1

Business, 22.06.2019 16:00

In macroeconomics, to study the aggregate means to study blank

Answers: 1

Business, 22.06.2019 18:20

Now ray has had the tires for two months and he notices that the tread has started to pull away from the tire. he has already contacted the place who sold the tires and calmly and accurately explained the problem. they didn’t him because they no longer carry that tire. so he talked with the manager and he still did not get the tire replaced. his consumer rights are being violated. pretend you are ray and write a letter to the company’s headquarters. here are some points to keep in mind when writing the letter: include your name, address, and account number, if appropriate. describe your purchase (name of product, serial numbers, date and location of purchase). state the problem and give the history of how you tried to resolve the problem. ask for a specific action. include how you can be reached.

Answers: 3

Business, 22.06.2019 19:50

What is the present value of the following cash flow stream at a rate of 12.0%? years: 0 1 2 3 4| | | | |cfs: $0 $1,500 $3,000 $4,500 $6,000a. $9,699b. $10,210c. $10,747d. $11,284e. $11,849

Answers: 3

You know the right answer?

Arlene is single and has taxable income of $18,000. her tax liability is currently $2,236. she has t...

Questions

History, 06.04.2020 09:41

Mathematics, 06.04.2020 09:41

Mathematics, 06.04.2020 09:45

English, 06.04.2020 09:45

History, 06.04.2020 09:46

Mathematics, 06.04.2020 09:46

Social Studies, 06.04.2020 09:47

History, 06.04.2020 09:47

Mathematics, 06.04.2020 09:48

History, 06.04.2020 09:48

Medicine, 06.04.2020 09:49

Spanish, 06.04.2020 09:50