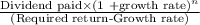

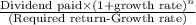

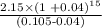

The jackson-timberlake wardrobe co. just paid a dividend of $2.15 per share on its stock. the dividends are expected to grow at a constant rate of 4 percent per year indefinitely. if investors require a return of 10.5 percent on the company’s stock,

(a)-what is the current price?

(b)-what will the price be in three years?

( will the price be 15 years?

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Which statement about the cost of the options is true? she would save $1,000 by choosing option b. she would save $5,650 by choosing option a. she would save $11,200 by choosing option b. she would save $11,300 by choosing option a.

Answers: 2

Business, 22.06.2019 08:30

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

Business, 22.06.2019 12:20

Consider 8.5 percent swiss franc/u.s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

Business, 22.06.2019 13:00

Apopular low-cost airline, parson corp., has gone out of business. although the service and price provided by the airline was what customers wanted, the larger airlines were able to drive the low-cost airline out of business through an aggressive price war. which component of the competitive environment does this illustrate? a) threat of new entrants b)competitors c) economic factors d) customers d) regulators

Answers: 1

You know the right answer?

The jackson-timberlake wardrobe co. just paid a dividend of $2.15 per share on its stock. the divide...

Questions

Mathematics, 25.03.2021 21:10

English, 25.03.2021 21:10

Mathematics, 25.03.2021 21:10

Mathematics, 25.03.2021 21:10

History, 25.03.2021 21:10

Mathematics, 25.03.2021 21:10

Biology, 25.03.2021 21:10

Mathematics, 25.03.2021 21:10

Mathematics, 25.03.2021 21:10

Mathematics, 25.03.2021 21:10

Mathematics, 25.03.2021 21:10

Mathematics, 25.03.2021 21:10