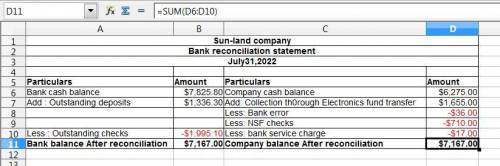

On july 31, 2022, sunland company had a cash balance per books of $6,275.00. the statement from dakota state bank on that date showed a balance of $7,825.80. a comparison of the bank statement with the cash account revealed the following facts.

(1) the bank service charge for july was $17.00.

(2) the bank collected $1,655.00 from a customer for sunland company through electronic funds transfer

(3) the july 31 receipts of $1,336.30 were not included in the bank deposits for july. these receipts were deposited by the company in a night deposit vault on july 31

(4) company check no. 2480 issued to l. taylor, a creditor, for $384.00 that cleared the bank in july was incorrectly entered as a cash payment on july 10 for $348.00

(5) checks outstanding on july 31 totaled $1,995.10

(6) on july 31, the bank statement showed an nsf charge of $710.00 for a check received by the company from w. krueger, a . customer, on account.

prepare the bank reconciliation as of july 31.

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

Afirm's before-tax cost of debt, rd, is the interest rate that the firm must pay on debt. because interest is tax deductible, the relevant cost of debt used to calculate a firm's wacc is the cost of debt, rd (1 – t). the cost of debt is used in calculating the wacc because we are interested in maximizing the value of the firm's stock, and the stock price depends on cash flows. it is important to emphasize that the cost of debt is the interest rate on debt, not debt because our primary concern with the cost of capital is its use in capital budgeting decisions. the rate at which the firm has borrowed in the past is because we need to know the cost of capital. for these reasons, the on outstanding debt (which reflects current market conditions) is a better measure of the cost of debt than the . the on the company's -term debt is generally used to calculate the cost of debt because more often than not, the capital is being raised to fund -term projects. quantitative problem: 5 years ago, barton industries issued 25-year noncallable, semiannual bonds with a $1,600 face value and a 8% coupon, semiannual payment ($64 payment every 6 months). the bonds currently sell for $845.87. if the firm's marginal tax rate is 40%, what is the firm's after-tax cost of debt? round your answer to 2 decimal places. do not round intermediate calcu

Answers: 3

Business, 22.06.2019 08:00

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Business, 22.06.2019 18:00

When peter metcalf describes black diamond’s manufacturing facility in china as a “greenfield project,” he means that partnered with a chinese company to buy the plant . of all market entry strategies, this one carries the lowest risk. because black diamond manufactures its outdoor sports products outside the united states, what risks must its managers be aware of?

Answers: 1

Business, 22.06.2019 19:40

Sue now has $125. how much would she have after 8 years if she leaves it invested at 8.5% with annual compounding? a. $205.83b. $216.67c. $228.07d. $240.08e. $252.08

Answers: 1

You know the right answer?

On july 31, 2022, sunland company had a cash balance per books of $6,275.00. the statement from dako...

Questions

Mathematics, 14.11.2020 01:00

Arts, 14.11.2020 01:00

Physics, 14.11.2020 01:00

English, 14.11.2020 01:00

Mathematics, 14.11.2020 01:00

Chemistry, 14.11.2020 01:00

Physics, 14.11.2020 01:00

English, 14.11.2020 01:00

Mathematics, 14.11.2020 01:00

Social Studies, 14.11.2020 01:00

Mathematics, 14.11.2020 01:00