Business, 05.11.2019 06:31 fatherbamboo

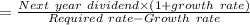

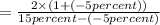

Astock is expected to pay a year-end dividend of $2.00, i. e., d1 = $2.00. the dividend is expected to decline at a rate of 5% a year forever (g = −5%). if the company is in equilibrium and its expected and required rate of return is 15%, which of the following statements is correct? a. the company's dividend yield 5 years from now is expected to be 10%.b. the constant growth model cannot be used because the growth rate is negative. c. the company's expected capital gains yield is 5%.d. the company's expected stock price at the beginning of next year is $9.50.e. the company's current stock price is $20.

Answers: 2

Another question on Business

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

Business, 22.06.2019 12:10

Drag each label to the correct location on the image determine which actions by a manager are critical interactions - listening to complaints - interacting with customers - responding to complaints - assigning staff duties -taking action to address customer grievances -keeping track of reservations

Answers: 2

Business, 22.06.2019 19:00

Read the scenario. alfonso is 19 years old and has a high school diploma. recently, he was promoted to assistant manager at the fast-food restaurant where he has worked since the age of sixteen. his dream is to become the restaurant’s manager. what is his best option for achieving his dream? he should find another job and work his way up to a higher position. he should hope that his manager transfers to another location and that he is his replacement. he should attend classes at the local college to receive training in management. he should work hard, work longer hours, and remain assistant manager.

Answers: 2

Business, 22.06.2019 19:40

The common stock of ncp paid $1.35 in dividends last year. dividends are expected to grow at an annual rate of 5.30 percent for an indefinite number of years. a. if ncp's current market price is $22.57 per share, what is the stock's expected rate of return? b. if your required rate of return is 7.3 percent, what is the value of the stock for you? c. should you make the investment? a. if ncp's current market price is $22.57 per share, the stock's expected rate of return is

Answers: 3

You know the right answer?

Astock is expected to pay a year-end dividend of $2.00, i. e., d1 = $2.00. the dividend is expected...

Questions

Biology, 20.10.2019 10:30

Mathematics, 20.10.2019 10:30

History, 20.10.2019 10:30

Physics, 20.10.2019 10:30

Mathematics, 20.10.2019 10:30

Mathematics, 20.10.2019 10:30

Business, 20.10.2019 10:30

Physics, 20.10.2019 10:30

English, 20.10.2019 10:30

History, 20.10.2019 10:30

Health, 20.10.2019 10:30

Mathematics, 20.10.2019 10:30