Business, 05.11.2019 04:31 AutumnJoy12

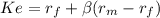

Currently, the risk free rate is 6% and the market risk premium is 5%. given this information, which of the following statements is correct? a. if a stock has a negative beta, its required return must also be negativeb. if a stock's beta doubles, its required return must also double. c.an index fund with beta = 1.0 should have a required return of 11%d. an idex fund with beta = 1.0 should have a required return greater than 11%e. an index fund with beta = 1.0 should have a required return less than 11%

Answers: 2

Another question on Business

Business, 21.06.2019 19:30

Maker-bot corporation has 10,000 shares of 10%, $90 par value, cumulative preferred stock outstanding since its inception. no dividends were declared in the first two years. if the company pays $400,000 of dividends in the third year, how much will common stockholders receive?

Answers: 2

Business, 21.06.2019 23:30

As manager of kids skids, meghan wants to develop her relationship management skills. in order to do this, she learns how to

Answers: 2

Business, 22.06.2019 11:40

Fanning company is considering the addition of a new product to its cosmetics line. the company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. relevant information and budgeted annual income statements for each of the products follow. skin cream bath oil color gel budgeted sales in units (a) 110,000 190,000 70,000 expected sales price (b) $8 $4 $11 variable costs per unit (c) $2 $2 $7 income statements sales revenue (a × b) $880,000 $760,000 $770,000 variable costs (a × c) (220,000) (380,000) (490,000) contribution margin 660,000 380,000 280,000 fixed costs (432,000) (240,000) (76,000) net income $228,000 $140,000 $204,000 required: (a) determine the margin of safety as a percentage for each product. (b) prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. (c) for each product, determine the percentage change in net income that results from the 20 percent increase in sales. (d) assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? (e) assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?

Answers: 1

Business, 22.06.2019 11:40

If kroger had whole foods’ number of days’ sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative to its actual average inventory position? round interim calculations to one decimal place and your final answer to the nearest million.

Answers: 2

You know the right answer?

Currently, the risk free rate is 6% and the market risk premium is 5%. given this information, which...

Questions

Mathematics, 23.02.2021 06:00

Mathematics, 23.02.2021 06:00

Mathematics, 23.02.2021 06:00

Mathematics, 23.02.2021 06:00

Mathematics, 23.02.2021 06:00

English, 23.02.2021 06:00

Mathematics, 23.02.2021 06:00

Social Studies, 23.02.2021 06:00

History, 23.02.2021 06:00

Mathematics, 23.02.2021 06:00

Mathematics, 23.02.2021 06:00

Mathematics, 23.02.2021 06:00