Business, 02.11.2019 07:31 benbeltran9030

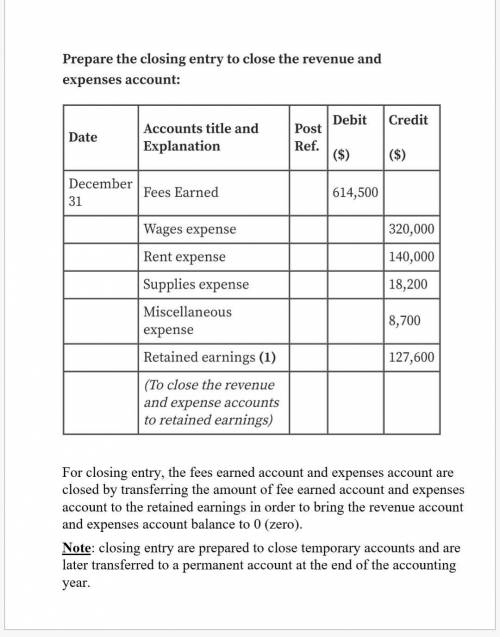

Closing entries with net income automation services co. offers its services to companies desiring to use technology to improve their operations. after the accounts have been adjusted at december 31, the end of the fiscal year, the following balances were taken from the ledger of automation services: fees earned dividends rent expense retained earnings supplies expense wages expense miscellaneous expense 614,500 45,000 140,000 ,250,000 18,200 8,700 journalize the closing entries.

Answers: 3

Another question on Business

Business, 22.06.2019 02:00

Southeastern bell stocks a certain switch connector at its central warehouse for supplying field service offices. the yearly demand for these connectors is 15,000 units. southeastern estimates its annual holding cost for this item to be $25 per unit. the cost to place and process an order from the supplier is $75. the company operates 300 days per year, and the lead time to receive an order from the supplier is 2 working days.a) find the economic order quantity.b) find the annual holding costs.c) find the annual ordering costs.d) what is the reorder point?

Answers: 2

Business, 22.06.2019 02:40

Which critical success factor improves with reduced cycle time, better quality standards, and improved efficiency when an is is implemented?

Answers: 3

Business, 22.06.2019 02:50

Seattle bank’s start-up division establishes new branch banks. each branch opens with three tellers. total teller cost per branch is $96,000 per year. the three tellers combined can process up to 90,000 customer transactions per year. if a branch does not attain a volume of at least 60,000 transactions during its first year of operations, it is closed. if the demand for services exceeds 90,000 transactions, an additional teller is hired and the branch is transferred from the start-up division to regular operations. required what is the relevant range of activity for new branch banks

Answers: 2

Business, 22.06.2019 11:30

Chuck, a single taxpayer, earns $80,750 in taxable income and $30,750 in interest from an investment in city of heflin bonds. (use the u.s. tax rate schedule.) (do not round intermediate calculations. round your answers to 2 decimal places.)

Answers: 2

You know the right answer?

Closing entries with net income automation services co. offers its services to companies desiring to...

Questions

Mathematics, 05.07.2019 15:50

History, 05.07.2019 15:50

Mathematics, 05.07.2019 15:50

Mathematics, 05.07.2019 15:50

Social Studies, 05.07.2019 15:50

Health, 05.07.2019 15:50

Social Studies, 05.07.2019 15:50

Mathematics, 05.07.2019 15:50

Mathematics, 05.07.2019 15:50

English, 05.07.2019 15:50

History, 05.07.2019 15:50

History, 05.07.2019 15:50

Mathematics, 05.07.2019 15:50

Mathematics, 05.07.2019 15:50