Business, 26.10.2019 01:43 prince2195

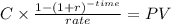

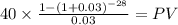

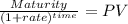

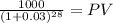

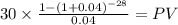

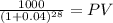

Bond x is a premium bond making semiannual payments. the bond pays a coupon rate of 8 percent, has a ytm of 6 percent, and has 14 years to maturity. bond y is a discount bond making semiannual payments. this bond pays a coupon rate of 6 percent, has a ytm of 8 percent, and also has 14 years to maturity. the bonds have a $1,000 par value. what is the price of each bond today? if interest rates remain unchanged, what do you expect the price of these bonds to be one year from now? in five years? in 10 years? in 12 years? in 14 years?

Answers: 2

Another question on Business

Business, 21.06.2019 20:20

The 2016 financial statements of the new york times company reveal average shareholders’ equity attributable to controlling interest of $837,283 thousand, net operating profit after tax of $48,032 thousand, net income attributable to the new york times company of $29,068 thousand, and average net operating assets of $354,414 thousand. the company's return on net operating assets (rnoa) for the year is: select one: a. 3.5% b. 6.9% c. 13.6% d. 18.7% e. there is not enough information to calculate the ratio.

Answers: 1

Business, 22.06.2019 13:50

When used-car dealers signal the quality of a used car with a warranty, a. buyers believe the signal because the cost of a false signal is high b. it is not rational to believe the signal because some used-car dealers are crooked c. the demand for lemons is eliminated d. the price of a lemon rises above the price of a good used car because warranty costs on lemons are greater than warranty costs on good used cars

Answers: 2

Business, 22.06.2019 20:20

You are the cfo of a u.s. firm whose wholly owned subsidiary in mexico manufactures component parts for your u.s. assembly operations. the subsidiary has been financed by bank borrowings in the united states. one of your analysts told you that the mexican peso is expected to depreciate by 30 percent against the dollar on the foreign exchange markets over the next year. what actions, if any, should you take

Answers: 2

Business, 23.06.2019 01:30

What is the name of the company and the stock symbol you chose? what is the p/e ratio? what information did you find about the company? why did you choose this stock? company name: stock symbol: p/e ratio: information about the company: why did you choose this stock?

Answers: 2

You know the right answer?

Bond x is a premium bond making semiannual payments. the bond pays a coupon rate of 8 percent, has a...

Questions

Biology, 21.07.2019 21:30

Biology, 21.07.2019 21:30

History, 21.07.2019 21:30

Biology, 21.07.2019 21:30

Biology, 21.07.2019 21:30

History, 21.07.2019 21:30

Social Studies, 21.07.2019 21:30