Business, 25.10.2019 23:43 camperjamari12

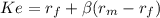

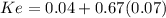

As a financial analyst, you are tasked with evaluating a capital-budgeting project. you were instructed to use the irr method, and you need to determine an appropriate hurdle rate. the risk-free rate is 4%, and the expected market rate of return is 11%. your company has a beta of 0.67, and the project that you are evaluating is considered to have risk equal to the average project that the company has accepted in the past. according to capm, the appropriate hurdle rate would be

Answers: 3

Another question on Business

Business, 21.06.2019 17:30

The digby's workforce complement will grow by 20% (rounded to the nearest person) next year. ignoring downsizing from automating, what would their total recruiting cost be? assume digby spends the same amount extra above the $1,000 recruiting base as they did last year. select: 1 $2,840,000 $3,408,000 $570,000 $475,000

Answers: 1

Business, 21.06.2019 19:20

You wish to buy a cabin in 15 years. today, the cabin costs $150,000. you believe the price of the cabin will inflate at 4% annually. you want to invest a single amount of money (lump sum) today and have the money grow to equal the future purchase price of the cabin 15 years from now. if you can earn 10% annually on your investments, how much do you need to invest now, in order to be able to purchase the cabin?

Answers: 3

Business, 21.06.2019 20:40

Which of the following explains why the government sets a required reserve ratio for private banks? a. to allow the government to control the interest rate charged on loans. b. to prevent banks from printing too much money and causing inflation. c. to make sure banks don't run out of money when customers make withdrawals. d. to enable the regulation of risk levels in the decision process of offering loans. 2b2t

Answers: 1

Business, 22.06.2019 02:30

Acompany factory is considered which type of resource a.land b.physical capital c.labor d.human capital

Answers: 2

You know the right answer?

As a financial analyst, you are tasked with evaluating a capital-budgeting project. you were instruc...

Questions

Mathematics, 22.10.2020 17:01

Mathematics, 22.10.2020 17:01

Mathematics, 22.10.2020 17:01

Mathematics, 22.10.2020 17:01

English, 22.10.2020 17:01

Mathematics, 22.10.2020 17:01

Mathematics, 22.10.2020 17:01

Computers and Technology, 22.10.2020 17:01

Social Studies, 22.10.2020 17:01

Mathematics, 22.10.2020 17:01

Mathematics, 22.10.2020 17:01

History, 22.10.2020 17:01