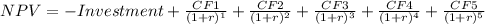

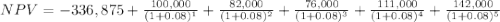

Afirm is reviewing an investment opportunity that requires an initial cash outlay of $336,875 and promises to return the following irregular payments: year 1: $100,000 year 2: $82,000 year 3: $76,000 year 4: $111,000 year 5: $142,000 if the required rate of return for the firm is 8%, what is the net present value of the investment? (you'll need to use your financial calculator.)

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

An annuity that goes on indefinitely is called a perpetuity. the payments of a perpetuity constitute a/an series. the equation is: a stock with no maturity is an example of a perpetuity. quantitative problem: you own a security that provides an annual dividend of $170 forever. the security’s annual return is 9%. what is the present value of this security? round your answer to the nearest cent. $

Answers: 2

Business, 22.06.2019 07:30

An instance where sellers should work to keep relationships with customers is when they instance where selllars should work to keep relationships with customers is when they feel that the product

Answers: 1

Business, 22.06.2019 12:00

Select the correct answer. martha is a healer, a healthcare provider, and an experienced nurse. she wants to share her daily experiences, as well as her 12 years of work knowledge, with people who may be interested in health and healing. which mode of internet communication can martha use? a. wiki b. email c. message board d. chat e. blog

Answers: 2

Business, 22.06.2019 19:40

Last year ann arbor corp had $155,000 of assets, $305,000 of sales, $20,000 of net income, and a debt-to-total-assets ratio of 37.5%. the new cfo believes a new computer program will enable it to reduce costs and thus raise net income to $33,000. assets, sales, and the debt ratio would not be affected. by how much would the cost reduction improve the roe? a. 11.51%b. 12.11%c. 12.75%d. 13.42%e. 14.09%

Answers: 3

You know the right answer?

Afirm is reviewing an investment opportunity that requires an initial cash outlay of $336,875 and pr...

Questions

History, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

Geography, 30.01.2021 01:00

Chemistry, 30.01.2021 01:00

Social Studies, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

English, 30.01.2021 01:00

French, 30.01.2021 01:00

Mathematics, 30.01.2021 01:00

English, 30.01.2021 01:00