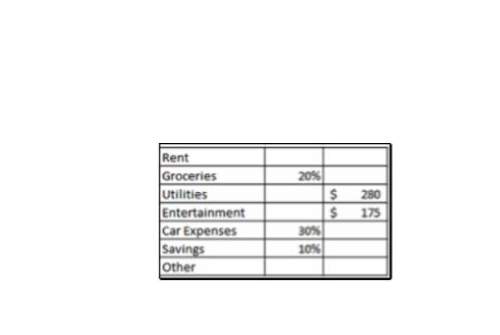

Amina makes $48,000 per year before taxes, and takes homes around $3,500 each month. given below is an unfinished table representing her monthly budget. complete the table and answer the questions below. (17 points: part i - 1 point; part ii 2 points; part iii - 1 point; part v - 5 points; part vi - 1 point; part vii - 6 points)

part i: what is the "rule of thumb" on how much amina should spend each month on rent? (1 point)

part ii: using the rule of thumb, calculate amina's monthly budget for rent. express the rent as a percentage of take-home pay ( round both answers to the nearest whole number). (2 points: 1 point each)

part iii: how much does amina spend each month on groceries? (1 point)

part iv: what percentage of her take-home pay is spent on utilities? (1 point)

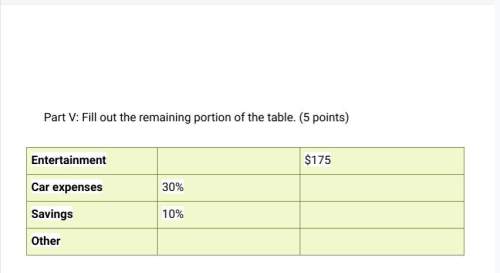

part v: fill out the remaining portion of the table. (5 points) (will provide pictures below)

part vi: arrange amina's expenses from greatest to least. (1 point)

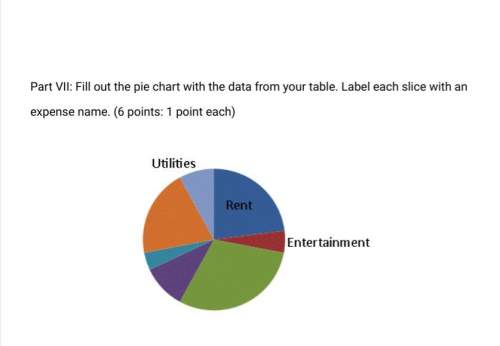

part vii: fill out the pie chart with the data from your table. label each slice with an expense name. (6 points: 1 point each)

Answers: 2

Another question on Business

Business, 21.06.2019 20:00

During 2017, sheridan company expected job no. 26 to cost $300000 of overhead, $500000 of materials, and $200000 in labor. sheridan applied overhead based on direct labor cost. actual production required an overhead cost of $260000, $510000 in materials used, and $150000 in labor. all of the goods were completed. what amount was transferred to finished goods?

Answers: 1

Business, 21.06.2019 23:30

Renaldo scanlon is a financial consultant. he earns $30 per hour and works 32.5 hours a week. what is his straight-time pay?

Answers: 1

Business, 22.06.2019 01:50

Atlas manufacturing produces a unique valve, and has the capacity to produce 50,000 valves annually. currently atlas produces 40,000 valves and is thinking about increasing production to 45,000 valves next year. what is the most likely behavior of total manufacturing costs and unit manufacturing costs given this change? a. total manufacturing costs will increase and unit manufacturing costs will also increase. b. total manufacturing costs will stay the same and unit manufacturing costs will stay the same. c. total manufacturing costs will increase and unit manufacturing costs will decrease. d. total manufacturing costs will increase and unit manufacturing costs will stay the same.

Answers: 1

Business, 22.06.2019 04:40

Select the correct answerwhat is the responsibility of each of the twelve federal reserve's banks in their districts? a.they set the prime rateob.they monitor functioning of banks in their through onsite and offsite reviewsc.they assess taxes in their destnictd.they write fiscal policies

Answers: 1

You know the right answer?

Amina makes $48,000 per year before taxes, and takes homes around $3,500 each month. given below is...

Questions

Spanish, 14.04.2021 18:40

English, 14.04.2021 18:40

Mathematics, 14.04.2021 18:40

Mathematics, 14.04.2021 18:40

Social Studies, 14.04.2021 18:40

Mathematics, 14.04.2021 18:40

Mathematics, 14.04.2021 18:40

Mathematics, 14.04.2021 18:40

English, 14.04.2021 18:40

Health, 14.04.2021 18:40

Mathematics, 14.04.2021 18:40