Business, 17.10.2019 04:10 kell22wolf

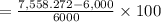

On january 1, 2012, albert invested $6,000 at 8 percent interest per year for three years. the cpi (times 100) on january 1, 2012, stood at 100. on january 1, 2013, the cpi was 110 on january 1, 2014, it was 120; and on january 1, 2015, the day albert’s investment matured, the cpi was 126. find the real rate of interest earned by albert in each of the three years and his total real return over the three-year period. assume that interest earnings are reinvested each year and themselves earn interest. hint: calculate inflation and real interest for each year and then calculate it for the three years as a whole. instructions: enter your responses rounded to one decimal place. if you are entering any negative numbers be sure to include a negative sign in front of those numbers. year real rate of interest2012 %2013 %2014 %total real rate of return: __%.

Answers: 2

Another question on Business

Business, 22.06.2019 12:30

Suppose a holiday inn hotel has annual fixed costs applicable to its rooms of $1.2 million for its 300-room hotel, average daily room rents of $50, and average variable costs of $10 for each room rented. it operates 365 days per year. the amount of operating income on rooms, assuming an occupancy* rate of 80% for the year, that will be generated for the entire year is *occupancy = % of rooms rented

Answers: 1

Business, 22.06.2019 15:10

Paying attention to the purpose of her speech, which questions can she eliminate? a. 1 and 2 b. 3 c. 2 and 4 d. 1-4

Answers: 2

Business, 22.06.2019 21:00

Which of the following statements is correct? stockholders should generally be happier than bondholders to have managers invest in risky projects with high potential returns as opposed to safe projects with lower expected returns. potential conflicts between stockholders and bondholders are increased if a firm's bonds are convertible into its common stock. takeovers are most likely to be attempted if the target firm’s stock price is above its intrinsic value. one advantage of operating a business as a corporation is that stockholders can deduct their pro rata share of the taxes the firm pays, thereby eliminating the double taxation investors would face in a partnership.

Answers: 1

Business, 22.06.2019 21:40

Heather has been an active participant in a defined benefit plan for 19 years. during her last 6 years of employment, heather earned $42,000, $48,000, $56,000, $80,000, $89,000, and $108,000, respectively (representing her highest-income years). calculate heather’s maximum allowable benefits from her qualified plan (assume that there are fewer than 100 participants). assume that heather’s average compensation for her three highest years is $199,700. calculate her maximum allowable benefits.

Answers: 3

You know the right answer?

On january 1, 2012, albert invested $6,000 at 8 percent interest per year for three years. the cpi (...

Questions

Mathematics, 15.07.2019 15:30

History, 15.07.2019 15:30

Social Studies, 15.07.2019 15:30

Mathematics, 15.07.2019 15:30

Mathematics, 15.07.2019 15:30

Mathematics, 15.07.2019 15:30

English, 15.07.2019 15:30

Mathematics, 15.07.2019 15:30

Social Studies, 15.07.2019 15:40