Business, 16.10.2019 04:30 shimmerandshine1

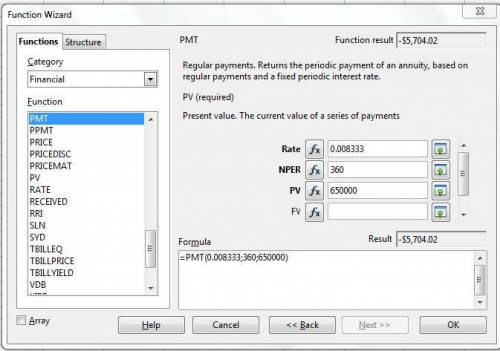

You’ve decided to buy a house that is valued at $1 million. you have $350,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. your bank has approved your $650,000 mortgage, and is offering a standard 30-year mortgage at a 10% fixed nominal interest rate (called the loan’s annual percentage rate or apr). under this loan proposal, your mortgage payment will be per month

(a) $7,130.03

(b) $8,841.23

(c) $5,704.02

(d) $7,700.43

Answers: 3

Another question on Business

Business, 22.06.2019 00:40

Eileen's elegant earrings produces pairs of earrings for its mail order catalogue business. each pair is shipped in a separate box. she rents a small room for $150 a week in the downtown business district that serves as her factory. she can hire workers for $275 a week. there are no implicit costs. what is the marginal product of the second worker?

Answers: 3

Business, 22.06.2019 19:30

About 20 years ago, sturdy light, inc., produced a sturdy, lightweight backpack in a market that was rapidly growing. sturdy light became a leader in this market. eventually, the backpack market reached the maturity stage and slowed down. however, by this time, sturdy light had developed a strong brand name and continued to steadily lead the market. which of the following describes this scenario? a. sturdy light was a star that developed into a cash cow. b. sturdy light was a question mark that developed into a star. c. sturdy light was a dog that developed into a question mark. d. sturdy light was a cash cow that developed into a star.

Answers: 2

Business, 22.06.2019 20:30

Afirm wants to strengthen its financial position. which of the following actions would increase its current ratio? a. reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase plant and equipment.b. use cash to repurchase some of the company's own stock.c. borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year.d. issue new stock, then use some of the proceeds to purchase additional inventory and hold the remainder as cash.e. use cash to increase inventory holdings.

Answers: 3

Business, 22.06.2019 23:30

Match the different financial tasks to their corresponding financial life cycle phases wealth protection, wealth accumulation and wealth distribution

Answers: 3

You know the right answer?

You’ve decided to buy a house that is valued at $1 million. you have $350,000 to use as a down payme...

Questions

Social Studies, 13.02.2020 01:30

History, 13.02.2020 01:30

Biology, 13.02.2020 01:30

Social Studies, 13.02.2020 01:30

Mathematics, 13.02.2020 01:30

Mathematics, 13.02.2020 01:31

![PV = P [\frac{1-(1+r)^{-n}}{r}]](/tpl/images/0324/0395/fd971.png)

![650,000 = P [\frac{1-(1+\frac{.1}{12})^{-360}}{\frac{.1}{12}}]](/tpl/images/0324/0395/11004.png)

![\frac{650000}{[\frac{1-(1+\frac{.1}{12})^{-360}}{\frac{.1}{12}}]} = P](/tpl/images/0324/0395/a4dfa.png)