Business, 11.10.2019 01:10 thelonewolf5020

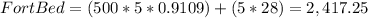

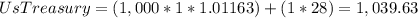

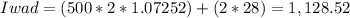

Broker k, who charges a fee of $28 for each bond sold, recommends that jim buy five par value $500 bonds from fort bend county, a par value $1,000 bond from the u. s. treasury, and two par value $500 bonds from iwad records. fort bend bonds are selling at 91.090, treasury bonds are selling at 101.163, and iwad records bonds are selling at 107.252. based on the current information, which broker’s bond package will cost jim less money up front, and how much less will it cost him?

Answers: 1

Another question on Business

Business, 21.06.2019 15:00

Becky fenton has 40/80/40 automobile insurance coverage. if two other people are awarded $75,000 each for injuries in an auto accident in which becky was judged at fault, how much of this judgment would the insurance cover?

Answers: 1

Business, 22.06.2019 05:30

U.s. internet advertising revenue grew at the rate of r(t) = 0.82t + 1.14 (0 ≤ t ≤ 4) billion dollars/year between 2002 (t = 0) and 2006 (t = 4). the advertising revenue in 2002 was $5.9 billion.† (a) find an expression f(t) giving the advertising revenue in year t.

Answers: 1

Business, 22.06.2019 18:00

Bond j has a coupon rate of 6 percent and bond k has a coupon rate of 12 percent. both bonds have 14 years to maturity, make semiannual payments, and have a ytm of 9 percent. a. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Answers: 2

You know the right answer?

Broker k, who charges a fee of $28 for each bond sold, recommends that jim buy five par value $500 b...

Questions

Computers and Technology, 19.02.2021 14:00

Biology, 19.02.2021 14:00

English, 19.02.2021 14:00

English, 19.02.2021 14:00

Mathematics, 19.02.2021 14:00

Social Studies, 19.02.2021 14:00

Computers and Technology, 19.02.2021 14:00

Engineering, 19.02.2021 14:00

Chemistry, 19.02.2021 14:00

Social Studies, 19.02.2021 14:00