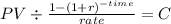

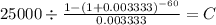

You want to buy a car, and a local bank will lend you $25,000. the loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 4% with interest paid monthly. what will be the monthly loan payment? what will be the loan's ear? do not round intermediate calculations. round your answer for the monthly loan payment to the nearest cent and for ear to two decimal places.

Answers: 2

Another question on Business

Business, 21.06.2019 19:40

Bear, inc. estimates its sales at 200,000 units in the first quarter and that sales will increase by 20,000 units each quarter over the year. they have, and desire, a 25% ending inventory of finished goods. each unit sells for $35. 40% of the sales are for cash. 70% of the credit customers pay within the quarter. the remainder is received in the quarter following sale. cash collections for the third quarter are budgeted at

Answers: 3

Business, 22.06.2019 16:00

What impact might an economic downturn have on a borrower’s fixed-rate mortgage? a. it might cause a borrower’s payments to go up. b. it might cause a borrower’s payments to go down. c. it has no impact because a fixed-rate mortgage cannot change. d. it has no impact because the economy does not affect interest rates.

Answers: 1

Business, 22.06.2019 17:20

States that if there is no specific employment contract saying otherwise, the employer or employee may end an employment relationship at any time, regardless of cause. rule of fair treatment due-process policy rule of law employment flexibility employment at will

Answers: 1

Business, 22.06.2019 18:00

What would not cause duff beer’s production possibilities curve to expand in the short run? a. improved manufacturing technology b. additional resources c. increased demand

Answers: 1

You know the right answer?

You want to buy a car, and a local bank will lend you $25,000. the loan will be fully amortized over...

Questions

History, 08.07.2019 06:00

English, 08.07.2019 06:00

History, 08.07.2019 06:00

Health, 08.07.2019 06:00

World Languages, 08.07.2019 06:00

Mathematics, 08.07.2019 06:00

History, 08.07.2019 06:00

History, 08.07.2019 06:00

Biology, 08.07.2019 06:00

Biology, 08.07.2019 06:00

History, 08.07.2019 06:00

![(1+0.04/12)^{60} = (1+ r_e)^{5}\\r_e = \sqrt[5]{(1+0.04/12)^{60}} - 1](/tpl/images/0292/5757/81510.png)