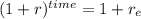

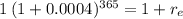

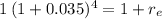

Periodic interest rates. you have a savings account in which you leave the funds for one year without adding to or withdrawing from the account. which would you rather have: a daily compounded rate of 0.040%, a weekly compounded rate of 0.285%, a monthly compounded rate of 1.35%, a quarterly compounded rater of 3.50%, a semiannually compounded rate of 8.5%, or an annually compounded rate of 18%? what is the effective annual rate (ear) of a daily compounded rate of 0.040%?

Answers: 3

Another question on Business

Business, 22.06.2019 19:40

On april 1, santa fe, inc. paid griffith publishing company $2,448 for 36-month subscriptions to several different magazines. santa fe debited the prepayment to a prepaid subscriptions account, and the subscriptions started immediately. what amount should appear in the prepaid subscription account for santa fe, inc. after adjustments on december 31 of the first year assuming the company is using a calendar-year reporting period and no previous adjustment has been made?

Answers: 1

Business, 22.06.2019 22:00

Your sister turned 35 today, and she is planning to save $60,000 per year for retirement, with the first deposit to be made one year from today. she will invest in a mutual fund that's expected to provide a return of 7.5% per year. she plans to retire 30 years from today, when she turns 65, and she expects to live for 25 years after retirement, to age 90. under these assumptions, how much can she spend each year after she retires? her first withdrawal will be made at the end of her first retirement year.

Answers: 3

Business, 22.06.2019 22:10

Afirm plans to begin production of a new small appliance. the manager must decide whether to purchase the motors for the appliance from a vendor at $10 each or to produce them in-house. either of two processes could be used for in-house production; process a would have an annual fixed cost of $200,000 and a variable cost of $7 per unit, and process b would have an annual fixed cost of $175,000 and a variable cost of $8 per unit. determine the range of annual volume for which each of the alternatives would be best. (round your first answer to the nearest whole number. include the indifference value itself in this answer.)

Answers: 2

Business, 23.06.2019 01:30

The stock market is -the section of the newspaper where you learn how much a stock is worth -a place where you buy and sell stock -an organized way for people to buy and sell stocks -the same as a brokerage firm

Answers: 1

You know the right answer?

Periodic interest rates. you have a savings account in which you leave the funds for one year withou...

Questions

Mathematics, 22.07.2021 08:10

Biology, 22.07.2021 08:10

English, 22.07.2021 08:10

Mathematics, 22.07.2021 08:10

English, 22.07.2021 08:10

Mathematics, 22.07.2021 08:10

Mathematics, 22.07.2021 08:10

Mathematics, 22.07.2021 08:10

English, 22.07.2021 08:10

Chemistry, 22.07.2021 08:10

Mathematics, 22.07.2021 08:10

English, 22.07.2021 08:10

English, 22.07.2021 08:10

History, 22.07.2021 08:10