Business, 02.10.2019 16:10 molinaemily009

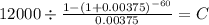

Mark is in the market for a used car. he has found the same sports car at two different dealerships and is now considering which dealer he should purchase the car from. dealer 1 requires mark to get the loan through their lending department. dealer 1 has told mark that because they do their own financing, they can get mark the very best loan possible and mark will only have to pay $291 per month for 60 months (5 years). dealer 2 is selling the car for $12000. dealer 2 has told mark he can use their financing or get his own lender, so mark talked with his bank and learned that he can get a 5 year car loan for 4.5% apr. dealer 2 has also offered mark a 5 year loan for 5.5%. based on these loan options, what is mark’s lowest monthly loan payment option?

Answers: 2

Another question on Business

Business, 21.06.2019 14:00

The new york stock exchange is an example of physical or individual

Answers: 2

Business, 21.06.2019 19:20

What is the most direct result of free trade supplying productive resources to areas where they're most needed? a. enhanced efficiency b. lower interest rates c. increasing specialization d. greater competition 2b2t

Answers: 3

Business, 22.06.2019 14:20

In canada, the reference base period for the cpi is 2002. by 2012, prices had risen by 21.6 percent since the base period. the inflation rate in canada in 2013 was 1.1 percent. calculate the cpi in canada in 2013. hint: use the information that “prices had risen by 21.6 percent since the base period” to find the cpi in 2012. use the inflation rate formula (inflation is the growth rate of the cpi) to find cpi in 2013, knowing the cpi in 2012 and the inflation rate. the cpi in canada in 2013 is round up your answer to the first decimal. 122.9 130.7 119.6 110.5

Answers: 1

Business, 22.06.2019 20:20

Which of the following entries would be made to record the requisition of $12,000 of direct materials and $6,900 of indirect materials? (assume that indirect materials are included in raw materials inventory.) a. manufacturing overhead 18,900 raw materials inventory 18,900 b. wip inventory 12,000 manufacturing overhead 6,900 raw materials inventory 18,900 c. raw materials inventory 18,900 wip inventory 18,900 d. wip inventory 18,900 raw materials inventory 18,900

Answers: 1

You know the right answer?

Mark is in the market for a used car. he has found the same sports car at two different dealerships...

Questions

Mathematics, 27.11.2020 14:00

English, 27.11.2020 14:00

Geography, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00

Business, 27.11.2020 14:00

Physics, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00

English, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00

Engineering, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00

Chemistry, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00