Business, 02.10.2019 03:30 naomifelixwoo

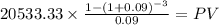

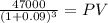

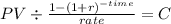

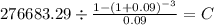

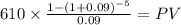

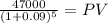

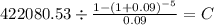

You are evaluating two different silicon wafer milling machines. the techron i costs $261,000, has a three-year life, and has pretax operating costs of $70,000 per year. the techron ii costs $455,000, has a five-year life, and has pretax operating costs of $43,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $47,000. if your tax rate is 35 percent and your discount rate is 9 percent, compute the eac for both machines

Answers: 1

Another question on Business

Business, 21.06.2019 16:30

Copyright law protects the expression of an idea so blank is protected by copyright

Answers: 1

Business, 22.06.2019 04:10

Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the company’s discount rate is 18%. after careful study, oakmont estimated the following costs and revenues for the new product: cost of equipment needed $ 230,000 working capital needed $ 84,000 overhaul of the equipment in year two $ 9,000 salvage value of the equipment in four years $ 12,000 annual revenues and costs: sales revenues $ 400,000 variable expenses $ 195,000 fixed out-of-pocket operating costs $ 85,000 when the project concludes in four years the working capital will be released for investment elsewhere within the company. click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables.

Answers: 2

Business, 22.06.2019 11:00

What is the correct percentage of texas teachers charged with ethics violations each year?

Answers: 2

Business, 22.06.2019 20:30

The former chairman of the federal reserve, alan greenspan, used the term "irrational exuberance" in 1996 to describe the high levels of optimism among stock market investors at the time. stock market indexes such as the s& p composite price index were at an all-time high. some commentators believed that the fed should intervene to slow the expansion of the economy. why would central banks want to clamp down when the economy is growing? a. to block the formation of unsustainable speculative asset bubbles. b. to curtail excessive profits in the banking system. c. to prevent inflationary forces from gathering momentum. d. all of the above. e. a and c only.

Answers: 3

You know the right answer?

You are evaluating two different silicon wafer milling machines. the techron i costs $261,000, has a...

Questions

Health, 06.05.2021 20:50

Computers and Technology, 06.05.2021 20:50

History, 06.05.2021 20:50

Mathematics, 06.05.2021 20:50

Mathematics, 06.05.2021 20:50

Mathematics, 06.05.2021 20:50

Mathematics, 06.05.2021 20:50

Geography, 06.05.2021 20:50

Mathematics, 06.05.2021 20:50

Mathematics, 06.05.2021 20:50