Business, 02.10.2019 01:30 shaelyn0920

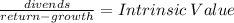

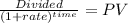

The duo growth company just paid a dividend of $1 per share. the dividend is expected to grow at a rate of 25% per year for the next 3 years and then to level off to 5% per year forever. you think the appropriate market capitalization rate is 20% per year. (a) what is your estimate of the intrinsic value of a share of the stock? (b) if the market price of a share is equal to this intrinsic value, what is the expected dividend yield? (c) what do you expect its price to be 1 year from now? is the implied capital gain consistent with your estimate of the dividend yield and the market capitalization rate? explain.

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

Suppose that hubert, an economist from an am talk radio program, and kate, an economist from a nonprofit organization on the west coast, are arguing over government bailouts. the following dialogue shows an excerpt from their debate: kate: to recent financial crises, the concept of bailouts is a hot topic for debate among everyone these days. hubert: indeed, it’s gotten crazy! a government bailout of severely distressed financial firms is unnecessary because free markets will properly price assets. kate: i don’t know about that. without a bailout of severely distressed financial firms, the economy will experience a deep recession. the disagreement between these economists is most likely due todifferences in scientific judgments . despite their differences, with which proposition are two economists chosen at random most likely to agree? business managers can raise profit more easily by reducing costs than by raising revenue. central banks should focus more on maintaining low unemployment than on maintaining low inflation. employers should not be restricted from outsourcing work to foreign nations

Answers: 3

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

Business, 22.06.2019 21:50

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

Business, 22.06.2019 22:00

Which of the following is the term for something that you can't live without 1. need 2. want 3. good 4. service

Answers: 1

You know the right answer?

The duo growth company just paid a dividend of $1 per share. the dividend is expected to grow at a r...

Questions

Physics, 24.06.2019 06:30

Chemistry, 24.06.2019 06:30

History, 24.06.2019 06:30

Geography, 24.06.2019 06:30

Business, 24.06.2019 06:30

Mathematics, 24.06.2019 06:30

History, 24.06.2019 06:30

English, 24.06.2019 06:30

![\left[\begin{array}{ccc}Year÷nds&PV\\0&1&1\\1&1.25&1.0417\\2&1.563&1.0854\\3&1.954&1.1308\\3&13.678&7.9155\\Total&&11.17\\\end{array}\right]](/tpl/images/0281/5746/52503.png)