Business, 01.10.2019 16:30 olivialaine31

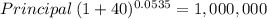

You would like to be a millionaire when you retire in 40 years, and how much you must invest today to reach that goal clearly depends on what rate of return you can earn. first, suppose you can earn 10.7% per year, and calculate how much you would have to invest today. second, suppose you can only earn half that percentage rate, and calculate how much you would have to invest today. divide the second by the first, to see how many times more you must invest today at half that annual rate grow it to $1 million over 40 years. (do not round the numbers in intermediate calculations, but enter your answer rounded to 2 decimal places (for example, 2.

Answers: 3

Another question on Business

Business, 22.06.2019 09:50

Is exploiting a distinctive competence or improving efficiency for competitive advantage. (a) cooptation (b) coalition (c) competitive intelligence (d) competitive aggression (e) smoothing

Answers: 1

Business, 22.06.2019 11:40

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

Business, 22.06.2019 14:10

Location test: question 1 of 54)water is a solvent because itoa. is made of moleculesob. dissolves many substancesc. is a saltd. has a large buffering capacity

Answers: 1

Business, 22.06.2019 20:50

Many potential buyers value high-quality used cars at the full-information market price of € p1 and lemons at € p2. a limited number of potential sellers value high-quality cars at € v1 ≤ p1 and lemons at € v2 ≤ p2. everyone is risk neutral. the share of lemons among all the used cars that might be potentially sold is € θ . suppose that the buyers incur a transaction cost of $200 to purchase a car. this transaction cost is the value of their time to find a car. what is the equilibrium? is it possible that no cars are sold

Answers: 2

You know the right answer?

You would like to be a millionaire when you retire in 40 years, and how much you must invest today t...

Questions

Biology, 19.12.2019 16:31

Mathematics, 19.12.2019 16:31

Social Studies, 19.12.2019 16:31

English, 19.12.2019 16:31

Social Studies, 19.12.2019 16:31

English, 19.12.2019 16:31

Mathematics, 19.12.2019 16:31

Mathematics, 19.12.2019 16:31

History, 19.12.2019 16:31

Mathematics, 19.12.2019 16:31

Mathematics, 19.12.2019 16:31