Business, 01.10.2019 06:00 amadileaks

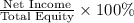

Afirm has adopted a policy whereby it will not seek any additional external financing. given this, what is the maximum growth rate of the firm if it has net income of $12,000, total equity of $40,000, total assets of $80,000, and a 40 percent dividend payout ratio?

Answers: 1

Another question on Business

Business, 22.06.2019 20:30

Casey communications recently issued new common stock and used the proceeds to pay off some of its short-term notes payable. this action had no effect on the company's total assets or operating income. which of the following effects would occur as a result of this action? a. the company's current ratio increased.b. the company's times interest earned ratio decreased.c. the company's basic earning power ratio increased.d. the company's equity multiplier increased.e. the company's debt ratio increased.

Answers: 3

Business, 23.06.2019 11:00

Jessica thinks that everyone would be better off if financial institutions stopped issuing credit. which statement accurately supports her argument? people would pay less in interest fees. people would have greater protection in case of emergencies. people would need to save for many years to buy a home or open a business. people would support the economy through purchases of more goods and services.

Answers: 1

Business, 23.06.2019 23:00

Co-workers in the sales department of a company work closely together. these members of the sales department together make up a group.

Answers: 1

You know the right answer?

Afirm has adopted a policy whereby it will not seek any additional external financing. given this, w...

Questions

Mathematics, 10.12.2020 02:50

Biology, 10.12.2020 02:50

Chemistry, 10.12.2020 02:50

Mathematics, 10.12.2020 02:50

History, 10.12.2020 02:50

English, 10.12.2020 02:50

History, 10.12.2020 02:50

Mathematics, 10.12.2020 02:50

Mathematics, 10.12.2020 02:50