Business, 01.10.2019 04:30 elysalmeron05

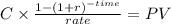

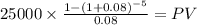

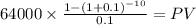

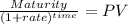

A. ed sloan wants to withdraw $25,000 (including principal) from an investment fund at the end of each year for five years. compute his required initial investment at the beginning of the first year if the fund earns 8% compounded annually? hint - think of this as a standard ordinary annuity. b. the market price of a $800,000, ten-year, 8% (pays interest annually) bond issue sold to yield an effective rate (i. e. market rate) of 10% is: c. elston company has entered into a lease agreement for office equipment which could be purchased for $39,927. elston company has, however, chosen to lease the equipment for $10,000 per year, payable at the end of each of the next 5 years. calculate the implied interest rate for the lease payments.

Answers: 1

Another question on Business

Business, 21.06.2019 14:10

What other aspects of ecuadorian culture, other than its predominant religion and language, might affect that country’s culture?

Answers: 1

Business, 22.06.2019 12:10

Compute the cost of not taking the following cash discounts. (use a 360-day year. do not round intermediate calculations. input your final answers as a percent rounded to 2 decimal places.)

Answers: 1

Business, 22.06.2019 15:40

Aprice control is: question 1 options: a)a tax on the sale of a good that controls the market price.b)an upper limit on the quantity of some good that can be bought or sold.c)a legal restriction on how high or low a price in a market may go.d)control of the price of a good by the firm that produces it.

Answers: 1

Business, 22.06.2019 20:00

Later movers do not face: entrenched competitors. reduced uncertainty over technologies. high growth markets. lower market uncertainty.

Answers: 3

You know the right answer?

A. ed sloan wants to withdraw $25,000 (including principal) from an investment fund at the end of ea...

Questions

Mathematics, 25.07.2019 05:30

History, 25.07.2019 05:30

Health, 25.07.2019 05:30

English, 25.07.2019 05:30

English, 25.07.2019 05:30

English, 25.07.2019 05:30

History, 25.07.2019 05:30

Physics, 25.07.2019 05:30