Business, 30.09.2019 23:00 alexis3567

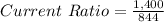

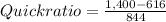

The most recent data from the annual balance sheets of n& b equipment company and jing foodstuffs corporation are as follows: balance sheet december 31st (millions of dollars) jing foodstuffs corporation n& b equipment company jing foodstuffs corporation n& b equipment company assets liabilities current assets current liabilities cash $574 $369 accounts payable $0 $0 accounts receivable 210 135 accruals 127 0 inventories 616 396 notes payable 717 675 total current assets $1,400 $900 total current liabilities $844 $675 net fixed assets long-term bonds 1,031 825 net plant and equipment 1,100 1,100 total debt $1,875 $1,500 common equity common stock $406 $325 retained earnings 219 175 total common equity $625 $500 total assets $2,500 $2,000 total liabilities and equity $2,500 $2,000 n& b equipment company’s current ratio is , and its quick ratio is ; jing foodstuffs corporation’s current ratio is , and its quick ratio is . note: round your values to four decimal places.

Answers: 3

Another question on Business

Business, 21.06.2019 18:00

Sara bought 12 3/4 cakes sara's friends ate 3/8 how much cake is left

Answers: 1

Business, 22.06.2019 18:00

Interpreting the income tax expense footnote the income tax footnote to the financial statements of fedex corporation follows. the components of the provision for income taxes for the years ended may 31 were as follows: ($ millions) 2010 2009 2008 current provision domestic federal $ 36 $ (35) $ 514 state and local 54 18 74 foreign 207 214 242 297 197 830 deferred provisions (benefit) domestic federal 408 327 31 state and local 15 48 (2) foreign (10) 7 32 413 382 61 provision for income taxes $ 710 $ 579 $ 891 (a)what is the amount of income tax expense reported in fedex's 2010, 2009, and 2008 income statements?

Answers: 2

Business, 23.06.2019 10:00

Brody and tanya recently sold some land they owned for $150,000. they received the land five years ago as a wedding gift from brody's aunt jeanette. she had already given them cash equal to the annual exclusion during that year. aunt jeanette purchased the land many years ago when the property was worth $20,000. at the time of the gift, the property was worth $100,000 and aunt jeanette paid $47,000 in gift tax. what is the long term capital gain on the sale of the property

Answers: 3

You know the right answer?

The most recent data from the annual balance sheets of n& b equipment company and jing foodstuff...

Questions

Biology, 10.04.2020 20:24

Mathematics, 10.04.2020 20:24

English, 10.04.2020 20:24

English, 10.04.2020 20:24

Mathematics, 10.04.2020 20:24

Biology, 10.04.2020 20:24

Mathematics, 10.04.2020 20:24