Business, 26.09.2019 17:20 montgomerykarloxc24x

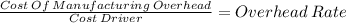

Pools manufactures swimming pool equipment. falmouth estimates total manufacturing overhead costs next year to be $ 1 comma 500 comma 000. falmouth also estimates it will use 46 comma 875 direct labor hours and incur $ 1 comma 250 comma 000 of direct labor cost next year. in addition, the machines are expected to be run for 50 comma 000 hours. compute the predetermined manufacturing overhead rate for next year under the following independent situations: 1. assume that the company uses direct labor hours as its manufacturing overhead allocation base. 2. assume that the company uses direct labor cost as its manufacturing overhead allocation base. 3. assume that the company uses machine hours as its manufacturing overhead allocation base. 1. compute the predetermined manufacturing overhead rate for next year assuming that the company uses direct labor hours as its manufacturing overhead allocation base. identify the formula and compute the predetermined manufacturing overhead rate for next year using direct labor hours as the manufacturing overhead allocation base.

Answers: 2

Another question on Business

Business, 22.06.2019 03:00

If you were running a company, what are at least two things you could do to improve its productivity.

Answers: 1

Business, 22.06.2019 06:40

10. which of the following is true regarding preretirement inflation? a. defined-benefit plans provide more inflation protection than defined-contribution plans. b. because of preretirement inflation, possible investment-related growth is increased for defined-contribution plans. c. all types of benefits are designed to cope with preretirement inflation. d. preretirement inflation is generally reflected in the increase in an employee's compensation level over a working career.

Answers: 3

Business, 22.06.2019 20:50

Swathmore clothing corporation grants its customers 30 days' credit. the company uses the allowance method for its uncollectible accounts receivable. during the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. at the fiscal year-end of december 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. at the end of 2012, accounts receivable were dollar 586.000 and the allowance account had a credit balance of dollar 50,000. accounts receivable activity for 2013 was as follows: the company's controller prepared the following aging summary of year-end accounts receivable: prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. (if no entry is required for a particular event, select "no journal entry required" in the first account field.) prepare the necessary year-end adjusting entry for bad debt expense. (if no entry is required for an event, select "no journal entry required" in the first account field.) what is total bad debt expense for 2013? calculate the amount of accounts receivable that would appear in the 2013 balance sheet?

Answers: 2

Business, 22.06.2019 23:00

You cannot make copies of media, even as a personal backup, without violating copyright. true

Answers: 3

You know the right answer?

Pools manufactures swimming pool equipment. falmouth estimates total manufacturing overhead costs ne...

Questions

Health, 18.07.2019 13:50

Biology, 18.07.2019 13:50

History, 18.07.2019 13:50

Mathematics, 18.07.2019 13:50

History, 18.07.2019 13:50

Biology, 18.07.2019 13:50

Mathematics, 18.07.2019 13:50