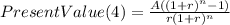

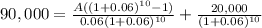

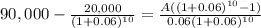

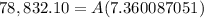

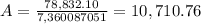

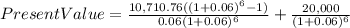

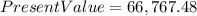

Apartially amortizing loan for $90,000 for 10 years is made at 6 percent interest. the lender and borrower agree that payments will be monthly and that a balance of $20,000 will remain and be repaid at the end of year 10. assuming 2 points are charged by the lender, what will be the yield if the loan is repaid at the end of year 10? what must the loan balance be if it is repaid after year 4? what will be the yield to the lender if the loan is repaid at the end of year 4?

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

Data pertaining to the current position of forte company are as follows: cash $437,500 marketable securities 170,000 accounts and notes receivable (net) 320,000 inventories 700,000 prepaid expenses 42,000 accounts payable 240,000 notes payable (short-term) 250,000 accrued expenses 310,000 required: 1. compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. round ratios to one decimal place. 2. compute the working capital, the current ratio, and the quick ratio after each of the following transactions, and record the results in the appropriate columns of the table provided. consider each transaction separately and assume that only that transaction affects the data given. round to one decimal place. a. sold marketable securities at no gain or loss, 75,000. b. paid accounts payable, 135,000. c. purchased goods on account, 100,000. d. paid notes payable, 105,000. e. declared a cash dividend, 125,000. f. declared a common stock dividend on common stock, 45,000. g. borrowed cash from bank on a long-term note, 205,000. h. received cash on account, 130,000. i. issued additional shares of stock for cash, 635,000. j. paid cash for prepaid expenses, 15,000.

Answers: 3

Business, 22.06.2019 12:50

Kyle and alyssa paid $1,000 and $4,000 in qualifying expenses for their two daughters jane and jill, respectively, to attend the university of california. jane is a sophomore and jill is a freshman. kyle and alyssa's agi is $135,000 and they file a joint return. what is their allowable american opportunity tax credit after the credit phase-out based on agi is taken into account?

Answers: 1

Business, 22.06.2019 18:10

Consumers who participate in the sharing economy seem willing to interact with total strangers. despite safety and privacy concerns, what do you think is the long-term outlook for this change in the way we think about interacting with people whom we don't know? how can businesses to diminish worries some people may have about these practices?

Answers: 1

Business, 22.06.2019 19:20

Although appealing to more refined tastes, art as a collectible has not always performed so profitably. during 2003, an auction house sold a sculpture at auction for a price of $10,211,500. unfortunately for the previous owner, he had purchased it in 2000 at a price of $12,177,500. what was his annual rate of return on this sculpture? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as

Answers: 2

You know the right answer?

Apartially amortizing loan for $90,000 for 10 years is made at 6 percent interest. the lender and bo...

Questions

Biology, 19.03.2020 00:37

Physics, 19.03.2020 00:37

Law, 19.03.2020 00:37

English, 19.03.2020 00:37

Mathematics, 19.03.2020 00:37

Chemistry, 19.03.2020 00:37

Biology, 19.03.2020 00:37

Mathematics, 19.03.2020 00:37

Biology, 19.03.2020 00:37

Mathematics, 19.03.2020 00:37

Social Studies, 19.03.2020 00:37

Mathematics, 19.03.2020 00:37