Business, 24.09.2019 03:20 austinpace423

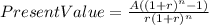

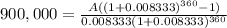

You’ve decided to buy a house that is valued at $1 million. you have $100,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price. your bank has approved your $900,000 mortgage, and is offering a standard 30-year mortgage at a 10% fixed nominal interest rate (called the loan’s annual percentage rate or apr). under this loan proposal, your mortgage payment will be per month. (note: round the final value of any interest rate used to four decimal places.)

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

Fanning books buys books and magazines directly from publishers and distributes them to grocery stores. the wholesaler expects to purchase the following inventory: april may june required purchases (on account) $ 111,000 $ 131,000 $ 143,000 fanning books accountant prepared the following schedule of cash payments for inventory purchases. fanning books suppliers require that 85 percent of purchases on account be paid in the month of purchase; the remaining 15 percent are paid in the month following the month of purchase. required complete the schedule of cash payments for inventory purchases by filling in the missing amounts. determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter.

Answers: 2

Business, 22.06.2019 19:50

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

Business, 22.06.2019 20:40

Robert owns a life insurance policy that he purchased when he first graduated college. it has a $100,000 death benefit and robert pays premiums for it every month out of his checking account. the insurance robert has is most likely da. permanent life insurance o b. term life insurance o c. group life insurance o d. individual life insurance

Answers: 1

Business, 23.06.2019 01:40

The new york times (nov. 30, 1993) reported that “the inability of opec to agree last week to cut production has sent the oil market into turmoil . . [leading to] the lowest price for domestic crude oil since june 1990.” why were the members of opec trying to agree to cut production? so they could save more oil for future consumption so they could lower the price so they could raise the price why do you suppose opec was unable to agree on cutting production? because each country has a different production capacity because each country experiences different production costs because each country has an incentive to cheat on any agreement the newspaper also noted opec’s view “that producing nations outside the organization, like norway and britain, should do their share and cut production.” what does the phrase “do their share” suggest about opec’s desired relationship with norway and britain? opec would like norway and britain to keep their production levels high. opec would like norway and britain to act competitively. opec would like norway and britain to join the cartel.

Answers: 2

You know the right answer?

You’ve decided to buy a house that is valued at $1 million. you have $100,000 to use as a down payme...

Questions

French, 09.04.2021 01:00

Mathematics, 09.04.2021 01:00

English, 09.04.2021 01:00

Chemistry, 09.04.2021 01:00

Biology, 09.04.2021 01:00

French, 09.04.2021 01:00

Mathematics, 09.04.2021 01:00

Chemistry, 09.04.2021 01:00

Social Studies, 09.04.2021 01:00

Mathematics, 09.04.2021 01:00