Business, 24.09.2019 03:20 brittneeyy

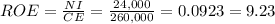

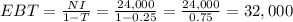

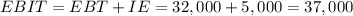

Baker industries’ net income is $24,000, its interest expense is $5,000, and its tax rate is 25%. its notes payable equals $24,000, long-term debt equals $80,000, and common equity equals $260,000. the firm finances with only debt and common equity, so it has no preferred stock. what are the firm’s roe and roic? do not round intermediate calculations. round your answers to two decimal places.

Answers: 1

Another question on Business

Business, 22.06.2019 14:30

In our daily interactions we can find ourselves listening to other people solely for the purpose of finding weakness in their positions so that we can formulate a convincing response. select one: true false

Answers: 1

Business, 23.06.2019 00:10

Mno corporation uses a job-order costing system with a predetermined overhead rate based on direct labor-hours. the company based its predetermined overhead rate for the current year on the following data: total estimated direct labor-hours 50,000 total estimated fixed manufacturing overhead cost $ 285,000 estimated variable manufacturing overhead per direct labor-hour $ 3.80 recently, job p123 was completed with the following characteristics: total actual direct labor-hours 20 direct materials $ 710 direct labor cost $ 500 the amount of overhead applied to job p123 is closest to:

Answers: 2

Business, 23.06.2019 00:30

Shelly bought a house five years ago for $150,000 and obtained an 80% loan. now the home is worth $140,000 and her loan balance has been reduced by $12,000. what is shelly's current equity?

Answers: 3

Business, 23.06.2019 04:40

Which is not true of birthday and/or annual review automatics? a. the purpose is to trigger a telephone call for a face-to-face meeting.b. quarterly automatic contacts decrease cross-sales and lead to reduced referrals.c. you are expected to stay in touch with all your active prospects and clients through two personal contacts each year?

Answers: 1

You know the right answer?

Baker industries’ net income is $24,000, its interest expense is $5,000, and its tax rate is 25%. it...

Questions

Mathematics, 07.01.2021 14:30

Physics, 07.01.2021 14:30

Mathematics, 07.01.2021 14:30

Chemistry, 07.01.2021 14:30

Mathematics, 07.01.2021 14:30

Mathematics, 07.01.2021 14:30

Advanced Placement (AP), 07.01.2021 14:30

Mathematics, 07.01.2021 14:30

English, 07.01.2021 14:30

Mathematics, 07.01.2021 14:30

History, 07.01.2021 14:30

Spanish, 07.01.2021 14:30

%

%

%

%