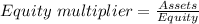

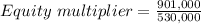

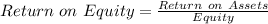

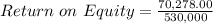

Sme company has a debt-equity ratio of .70. return on assets is 7.8 percent, and total equity is $530,000. a. what is the equity multiplier? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. what is the return on equity? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.) c. what is the net income? (do not round intermediate calculations and round your answer to the nearest whole number, e. g., 32.)

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

Emily sold the following investments during the year: stock date purchased date sold sales price cost basis a. 1,000 shares dot com co. 03-21-2007 02-04-2018 $20,000 $5,000 b. 500 shares big box store 05-19-2017 01-22-2018 $8,200 $7,500 c. 300 shares lotta fun, inc. 10-02-2017 09-21-2018 $3,000 $4,500 d. 700 shares local gas co. 06-17-2017 11-11-2018 $14,000 $17,000 for each stock, calculate the amount and the nature of the gain or loss.

Answers: 3

Business, 22.06.2019 02:30

On january 1, 2018, jay company acquired all the outstanding ownership shares of zee company. in assessing zee's acquisition-date fair values, jay concluded that the carrying value of zee's long-term debt (8-year remaining life) was less than its fair value by $21,600. at december 31, 2018, zee company's accounts show interest expense of $14,440 and long-term debt of $380,000. what amounts of interest expense and long-term debt should appear on the december 31, 2018, consolidated financial statements of jay and its subsidiary zee? long-term debt $401,600 $398,900 $401,600 $398,900 interest expense $17,140 $17,140 $11,740 $11,740 a. b. c. d.

Answers: 3

Business, 22.06.2019 12:40

Kumar consulting operates several stock investment portfolios that are used by firms for investment of pension plan assets. last year, one portfolio had a realized return of 12.6 percent and a beta coefficient of 1.15. the average t-bond rate was 7 percent and the realized rate of return on the s& p 500 was 12 percent. what was the portfolio's alpha?

Answers: 1

Business, 22.06.2019 14:40

Increases in output and increases in the inflation rate have been linked to

Answers: 2

You know the right answer?

Sme company has a debt-equity ratio of .70. return on assets is 7.8 percent, and total equity is $53...

Questions

Mathematics, 03.05.2020 14:02

Mathematics, 03.05.2020 14:02

Mathematics, 03.05.2020 14:02

Mathematics, 03.05.2020 14:02

Mathematics, 03.05.2020 14:02

Mathematics, 03.05.2020 14:02

Mathematics, 03.05.2020 14:02

Chemistry, 03.05.2020 14:02

Mathematics, 03.05.2020 14:02