Business, 23.09.2019 19:00 snehpatel3356

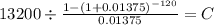

Mary's credit card situation is out of control because she cannot afford to make her monthly payments. she has three credit cards with the following loan balances and aprs: card 1, $4 comma 3004,300, 2121%; card 2, $5 comma 8005,800, 2525%; and card 3, $3 comma 1003,100, 1717%. interest compounds monthly on all loan balances. a credit card loan consolidation company has captured mary's attention by stating they can save mary 2323% per month on her credit card payments. this company charges 16.516.5% apr. is the company's claim correct? assume a 1010-year repayment period.

Answers: 3

Another question on Business

Business, 22.06.2019 14:40

Increases in output and increases in the inflation rate have been linked to

Answers: 2

Business, 22.06.2019 21:00

You are given the following information about aggregate demand at the existing price level for an economy: (1) consumption = $400 billion, (2) investment = $40 billion, (3) government purchases = $90 billion, and (4) net export = $25 billion. if the full-employment level of gdp for this economy is $600 billion, then what combination of actions would be most consistent with closing the gdp gap here?

Answers: 3

Business, 22.06.2019 21:20

1. what are the unique operational challenges to delivering fresh meals? 2. why is speed of delivery so important for delivered meals? what variety of options contribute to this performance metric? 3. how could operations management concepts be utilized to improve the performance of freshly? 4. what are your typical product delivery times? what would be required to speed these up? 5. what are your delivery batch quantities? how could you reduce batch size and reduce delivery cost simultaneously using operations management concepts?

Answers: 2

Business, 22.06.2019 22:00

You wish to retire in 13 years, at which time you want to have accumulated enough money to receive an annual annuity of $23,000 for 18 years after retirement. during the period before retirement you can earn 9 percent annually, while after retirement you can earn 11 percent on your money. what annual contributions to the retirement fund will allow you to receive the $23,000 annuity? use appendix c and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

Answers: 1

You know the right answer?

Mary's credit card situation is out of control because she cannot afford to make her monthly payment...

Questions

Computers and Technology, 20.09.2020 06:01

Chemistry, 20.09.2020 06:01

Business, 20.09.2020 06:01

Mathematics, 20.09.2020 06:01

Physics, 20.09.2020 06:01

Mathematics, 20.09.2020 06:01

Social Studies, 20.09.2020 06:01

Mathematics, 20.09.2020 06:01

History, 20.09.2020 06:01

Spanish, 20.09.2020 06:01

Mathematics, 20.09.2020 06:01

Law, 20.09.2020 06:01