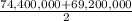

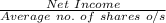

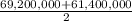

Suppose the following information is available for callaway golf company for the years 2017 and 2016. (dollars are in thousands, except share information.) 2017 2016 net sales $ 1,127,000 $ 1,134,600 net income (loss) 91,420 61,030 total assets 867,338 850,078 share information shares outstanding at year-end 61,400,000 69,200,000 preferred dividends 0 0 there were 74,400,000 shares outstanding at the end of 2015. (a) what was the company’s earnings per share for each year? (round answers to 2 decimal places, e. g. 15.25.)

Answers: 1

Another question on Business

Business, 22.06.2019 01:30

If a firm plans to issue new stock, flotation costs (investment bankers' fees) should not be ignored. there are two approaches to use to account for flotation costs. the first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. because the investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. the second approach involves adjusting the cost of common equity as follows: . the difference between the flotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the flotation cost adjustment. quantitative problem: barton industries expects next year's annual dividend, d1, to be $1.90 and it expects dividends to grow at a constant rate g = 4.3%. the firm's current common stock price, p0, is $22.00. if it needs to issue new common stock, the firm will encounter a 6% flotation cost, f. assume that the cost of equity calculated without the flotation adjustment is 12% and the cost of old common equity is 11.5%. what is the flotation cost adjustment that must be added to its cost of retaine

Answers: 1

Business, 22.06.2019 05:20

Carmen co. can further process product j to produce product d. product j is currently selling for $20 per pound and costs $15.75 per pound to produce. product d would sell for $38 per pound and would require an additional cost of $8.55 per pound to produce. what is the differential revenue of producing product d?

Answers: 2

Business, 22.06.2019 22:00

Gyou are in charge of making the work schedule for the next two weeks. typically this is not a difficult task as you work at a routine 8am – 5pm company. however, over the next two weeks you are required to schedule someone to be in the office each saturday. after contemplating this for a few days you make the schedule and assignments. before posting the schedule for everyone you decide that it is a good idea to meet personally with the two people you have scheduled to work the weekend. what do you say to them? what is your desired outcome?

Answers: 3

You know the right answer?

Suppose the following information is available for callaway golf company for the years 2017 and 2016...

Questions

Mathematics, 01.06.2020 06:58

Mathematics, 01.06.2020 06:58

Computers and Technology, 01.06.2020 06:58

Mathematics, 01.06.2020 06:58

Geography, 01.06.2020 06:58

Business, 01.06.2020 06:58

Mathematics, 01.06.2020 06:58

Mathematics, 01.06.2020 06:58

Mathematics, 01.06.2020 06:58

History, 01.06.2020 07:57