Business, 18.09.2019 02:00 paigemeyers6

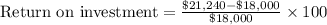

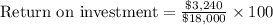

You recently invested $18,000 of your savings in a security issued by a large company. the security agreement pays you 6 percent per year and has a maturity three years from the day you purchased it. what is the total cash flow you expect to receive from this investment, separated into the return on your investment and the return of your investment?

Answers: 2

Another question on Business

Business, 21.06.2019 16:00

Suppose matt and bree go out to get pizza. they order breadsticks and a large pepperoni pizza. after eating the breadsticks, and one piece of pizza bree decides to have an additional piece, but she does not eat a third piece. if bree is a rational individual why did she not eat the third piece of pizza? the marginal cost of the

Answers: 2

Business, 22.06.2019 17:50

Which of the following is an element of inventory holding costs? a. material handling costs b. investment costs c. housing costs d. pilferage, scrap, and obsolescence e. all of the above are elements of inventory holding costs.

Answers: 1

Business, 22.06.2019 20:00

Later movers do not face: entrenched competitors. reduced uncertainty over technologies. high growth markets. lower market uncertainty.

Answers: 3

Business, 23.06.2019 02:30

Cadillac's portfolio consists of sedans, a crossover, a sport utility vehicle, and a high-performance version of the sedan. the sedans are sold through the cadillac dealer network, but the high-performance version is sold in limited volumes and is not available at all dealers. this difference in availability is an example of how the products within the cadillac portfolio are differentiated by the

Answers: 3

You know the right answer?

You recently invested $18,000 of your savings in a security issued by a large company. the security...

Questions

Mathematics, 25.03.2020 20:31

Physics, 25.03.2020 20:32

Mathematics, 25.03.2020 20:32

Social Studies, 25.03.2020 20:32